See standardized performance at the end.

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”'

— Charles Mackay

In a year in which trillions of dollars have poured into giant tech stocks in search of AI’s promise, scores of well-run, already profitable, and attractively priced businesses have been begging for attention. Yet we are confident the mega-cap momentum party won’t last forever and encouraged by the fact that interest in small value is building as the market is broadening out.

In the fourth quarter, the Russell 2000® Value Index returned 3.26%, outpacing the 2.66% gains for the S&P 500. As a result of the year-end rally, small stocks nearly pulled even with large caps in 2025, marking their best relative performance since the pandemic.

Part of this is due to strengthening fundamentals and earnings. Profit growth for small companies is on track to surpass that of large caps for the first time in 13 quarters. We believe this trend is likely to continue as the Federal Reserve lowers interest rates and as the regulatory backdrop improves — both factors that have historically benefited emerging businesses more than giant multinationals. In 2025, the total cost of regulations, as a percentage of GDP, fell by 0.24% after climbing consistently over the past two decades, according to data compiled by the American Action Forum.

Another factor contributing to the broadening market is valuations. There are signs that investors are finally beginning to appreciate how attractively priced small stocks are. In the past quarter, for example, four of our Strategy’s holdings were taken private, raising our take-out total to 14 over the past year.

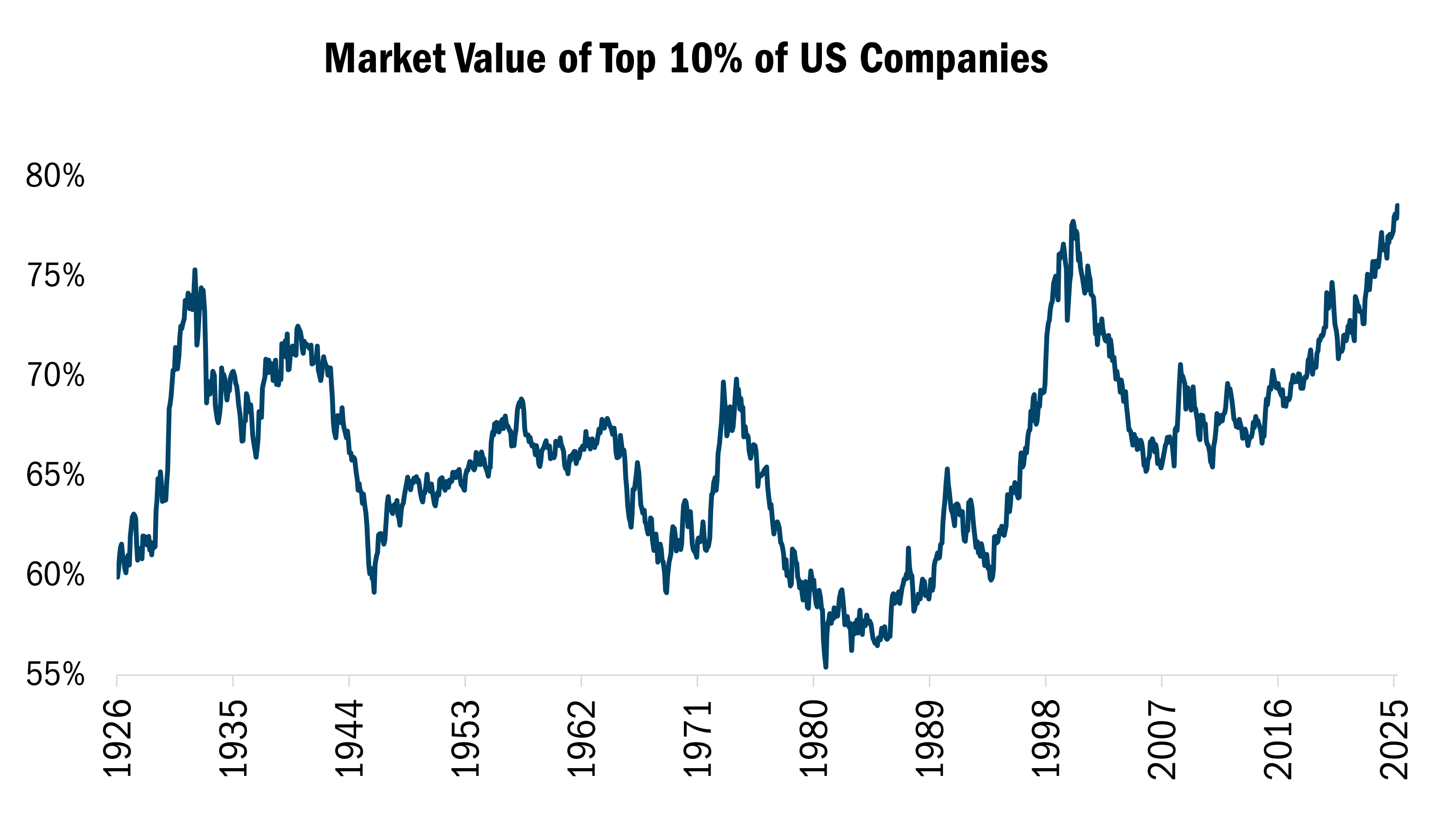

However, just 10% of companies account for more than 75% of the market’s overall capitalization, so concentration is likely to persist (see the chart below). But this reminds us of the observations of the 19th century Scottish writer Charles Mackey, who studied cultural fads and investment bubbles. Mackey observed that while crowds coalesce quickly, the unwinding of manias tends to take place more sporadically and gradually as individuals “recover their senses slowly and one by one.” This is why we believe we’re still in the first or second inning of the small-cap rebound.

Source: Kenneth R. French Data Library at Dartmouth via Allied Investment Advisors, Monthly data from 7/1/1926 to 10/1/2025. This chart represents the Market Value of Top 10% of US Companies through Kenneth R. French U.S. Research Returns Data. Kenneth R. French's U.S. Research Returns Data is a comprehensive dataset that captures the performance of U.S. stocks over time. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Despite the promising opportunity set, it’s important for investors not to get ahead of themselves. At Heartland, our 10 Principles of Value Investing™ require us to make portfolio decisions based on rigorous fundamental factors. This focus on low valuations, high-quality balance sheets, financial soundness, and positive earnings dynamics, among other attributes, has served us and our clients well for more than 41 years. Our process goes beyond this 10-point system, as we also monitor our exposures across sectors, industries, factors, and other risk considerations. By doing so, we aim to capitalize on dislocations in the market.

In the fourth quarter, the Heartland Value Fund gained 2.61%, compared with the 3.26% return for the Russell 2000® Value Index. While the Fund slightly underperformed its benchmark in the quarter, it has outpaced the index over the past one, three, five, and 10 years and since inception in 1984.

During the quarter, stock selection accounted for most of our underperformance relative to the benchmark. Health Care accounted for nearly all the negative selection effect. Our results were more the outcome of what we didn’t own than our actual holdings in the sector. Biotech companies in the benchmark soared in October and November, which is a good example of the speculation which persists. However, we don’t have direct exposure to this group, as many are profitless. We are, though, actively examining our Health Care stocks as several were among our portfolio’s biggest detractors in the quarter.

An example of a Health Care holding that struggled in the quarter was Integer Holdings Corporation (ITGR), which specializes in the design, development, and production of medical technologies and components. In late October, Integer’s stock sank more than 30% after the company significantly lowered its outlook for growth and margin expansion in 2026, as several products experienced slower market adoption than was expected. But management expects these headwinds to be short-lived, with a robust portfolio of higher growth and margin products coming to market, which should allow the company to get back on track. The company still expects to outgrow its industry peers by 2% while growing earnings before interest and taxes (EBIT) at twice the rate of sales.

Even better, the company announced a $200 million stock repurchase authorization after the selloff, increasing our conviction that the shares are materially undervalued. This confidence drove us to increase our exposure to Integer in the quarter.

Another position we increased was Columbus McKinnon (CMCO), which designs, manufactures, and distributes materials, handling products, and systems used in a variety of industrial applications, including lifting, automation, and precision conveyance. Early this year, CMCO reported slower-than-expected Q3 results, citing slowing industry demand driven by U.S. policy uncertainty. By itself, that would have likely triggered a mid-single-digit to high-single-digit selloff based on historic price reactions. However, management also announced a $2.7 billion acquisition of a competitor, Kito Crosby, which sent the stock plummeting more than 40% due to concerns surrounding execution and an increased leverage profile upon closing.

At current prices, we believe Columbus has a compelling risk/reward profile as management seeks to reduce leverage and improve the growth and margin profile of the consolidated business. Management is targeting mid-20% EBITDA margins upon integration, up from 15.5% in FY25 pre-acquisition.

In our opinion, CMCO can rerate closer to its industrial peers that trade at an average of 12x EV/EBITDA. Meanwhile, our view of the stock’s attractive valuations seems to be validated by aggressive insider buying by management in the aftermath of the Q3 selloff.

A good illustration that true value can be realized with patience is Alexander & Baldwin (ALEX). When we originally initiated a position in this Hawaii-based real estate investment trust in the summer of 2024, we were significantly underweight in our Real Estate exposure, relative to our benchmark. In addition, the sector was the third-largest contributor to our portfolio’s “active risk” at the time. So, we sought to expand our exposure to the sector but were looking to do so in a cautious way.

From a risk/reward standpoint, ALEX looked favorable to most other REITs at the time. We liked how ALEX divested a non-core construction business, making this a pure-play REIT with assets strictly in Hawaii. And we were drawn to historically low industrial vacancies in the State as well as the company’s strong absorption rate relative to its peers.

Over the past six months, however, Alexander & Baldwin shares sold off materially over concerns of slowing tourism in Hawaii. This is despite the fact that little of ALEX’s properties are on resorts or directly exposed to travel. Actual real estate fundamentals in the Aloha State remain strong with industrial vacancies hovering at just around 2%. The company also enjoyed a robust pipeline of pre-leased developments to drive earnings growth and a strong balance sheet with below-average leverage, at 3.5x net debt to EBITDA.

Nevertheless, the stock was down more than 14% through the first two months of the quarter — until Dec. 8, when a group of investors agreed to take the company private at a 40% premium, which was close to our evaluation of fair value. While ALEX wasn’t a huge winner, the takeout boosted the holding’s performance to close out the year and demonstrated that other investors are starting to pay attention to the companies we focus on.

One by one, investors seem to be recovering their senses, to borrow a phrase from Charles Mackay. This is bringing renewed attention to small stocks, which have been overlooked, undervalued, under-followed and under-owned for some time. This gives us hope, as does improving market breadth, which should be positive not just for Heartland’s process but for active management in general.

We believe successful active managers have to pair promising opportunities with a disciplined approach, to be mindful not only of the risk/reward proposition of individual securities but of their overall portfolio. At Heartland, this bottom-up focus on the fundamentals, coupled with a top-to-bottom assessment of our portfolio, has served our clients well for more than four decades. We suspect it’s also going to come in very handy in the years ahead.

Fundamentally yours,

The Heartland Investment Team

Scroll over to view complete data

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Investor Class | 11.32 | 7.38 | 8.16 | 9.80 | 11.49 | 16.26 | 15.98 | 15.98 | 2.61 |

| Value Institutional Class | 11.41 | 7.55 | 8.33 | 9.97 | 11.65 | 16.45 | 16.17 | 16.17 | 2.64 |

| Russell 2000® Value | 10.50 | 7.40 | 8.73 | 9.27 | 8.88 | 11.73 | 12.59 | 12.59 | 3.26 |

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Fund is 12/28/1984 for the investor class and 5/1/2008 for the institutional class.

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional classes of the Value Fund are 1.06% and 0.91%, respectively.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional classes of the Value Fund are 1.06% and 0.91%, respectively.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information may be found in the Funds' prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing.

As of 12/31/2025, Alexander & Baldwin, Inc. (ALEX), Columbus McKinnon Corporation (CMCO), and Integer Holdings Corporation (ITGR), represented 0.93%, 0.88%, and 1.55% of the Value Fund’s net assets, respectively.

Statements regarding securities are not recommendations to buy or sell.

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

The Value Fund invests primarily in small companies selected on a value basis. Such securities generally are more volatile and less liquid than those of larger companies.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The Value Fund seeks long-term capital appreciation through investing in small companies.

The above individuals are registered representatives of ALPS Distributors, Inc.

The Fund’s performance information included in regulatory filings includes a required index that represents an overall securities market (Regulatory Benchmark). In addition, the Fund's regulatory filings may also include an index that more closely aligns to the Fund's investment strategy (Strategy Benchmark(s)). The Fund's performance included in marketing and advertising materials and information other than regulatory filings is generally compared only to the Strategy Benchmark.

The Heartland Funds are distributed by ALPS Distributors, Inc.

The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

There is no guarantee that a particular investment strategy will be successful.

Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Because of ongoing market volatility, performance may be subject to substantial short-term changes.

Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

There is no assurance that dividend-paying stocks will mitigate volatility.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group.

Data sourced from FactSet: Copyright 2025 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved.

Artificial intelligence (AI) is intelligence is perceiving, synthesizing, and inferring information—demonstrated by computers, as opposed to intelligence displayed by humans or by other animals. Book Value is the sum of all of a company’s assets, minus its liabilities. Bottom-up is an investment approach that de-emphasizes the significance of economic and market cycles. This approach focuses on the analysis of individual stocks and the investor focuses his or her attention on a specific company rather than on the industry in which that company operates or on the economy as a whole. Cash Per Share is calculated by dividing the free cash flow of a company by the number of shares outstanding. Free Cash Flow is the amount of cash a company has after expenses, debt service, capital expenditures, and dividends. The higher the free cash flow, the stronger the company’s balance sheet. ISM Manufacturing PMI (Purchasing Managers Index) is an index based on surveys of more than 400 manufacturing firms by the Institute for Supply Management (ISM). The PMI index is an indicator of the economic health of the manufacturing sector based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. A reading over 50 represents that the industry is expanding, under 50 represents a contraction, while a reading at 50 represents no change. NFIB Small Business Survey is conducted monthly and drawn from the National Federation of Independent Business membership. The term "small business" is defined as an independent (not publicly-held or held by an entity that is publicly-held), for-profit enterprise that employs between 1 and 250 people, not including the owners. Tangible Book Value is the sum of all of a company’s assets, minus its liabilities and intangible assets, such as goodwill. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Russell Investment Group. Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price/book ratios and lower forecasted growth characteristics. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. S&P 600 is an index of small-cap stocks managed by Standard & Poor's. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements. This is determined by specific metrics such as public float, market capitalization, and financial viability, among other factors. 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.

Heartland’s investing glossary provides definitions for several terms used on this page.