HRTVX, HNTVX

Pursues long-term capital appreciation by investing in micro- and small-cap companies

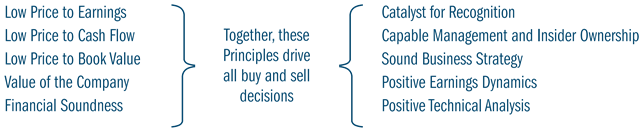

The Heartland Value Fund seeks long-term capital appreciation by investing in undervalued micro and small cap stocks. The Fund utilizes Heartland’s 10 Principles of Value Investing™ for stock analysis along with a collection of rules and tools designed to construct the overall portfolio such that stock selection is the primary driver of relative performance. This approach helps navigate the asset class and may increase the likelihood of potential outperformance relative to the Russell 2000® Value Index.

12/31/2025

Scroll over to view complete data

| Investor Class | Institutional Class | |

|---|---|---|

| Ticker | HRTVX | HNTVX |

| CUSIP | 422359109 | 422352831 |

| Inception Date | 12/28/1984 | 5/1/2008 |

| Assets | 696 million | 191 million |

| Investor Class ($) | Institutional Class ($) | |

|---|---|---|

| Initial Investment | 1,000 | 500,000 |

| IRA Initial Investment | 500 | 500,000 |

| Subsequent Investments | 100 | 100 |

Paid directly from total investment

|

Investor Class (%) |

Institutional Class (%) |

|

|---|---|---|

| Load | 0 | 0 |

| Sales Charge | 0 | 0 |

| Exchange Fee | 0 | 0 |

| Redemption Fee* | 2 | 2 |

*If shares are redeemed or exchanged within 10 days of purchase

Paid annually as a percentage of total investment value*

| Investor Class (%) |

Institutional Class (%) |

|

|---|---|---|

| Management Fee | 0.75 | 0.75 |

| 12b-1 Distribution Fee | 0.13 | 0.00 |

| Other Expenses | 0.18 | 0.16 |

| Total Annual Fund Operating Expenses | 1.06 | 0.91 |

*As stated in the prospectus dated 5/1/2025

Scroll over to view complete data

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Investor Class | 11.62 | 7.51 | 8.62 | 12.21 | 12.21 | 18.37 | 32.58 | 13.40 | 13.40 |

| Value Institutional Class | 11.70 | 7.67 | 8.80 | 12.39 | 12.37 | 18.56 | 32.81 | 13.44 | 13.44 |

| Russell 2000® Value | 10.68 | 7.44 | 8.99 | 10.90 | 7.67 | 12.39 | 24.95 | 8.92 | 8.92 |

*Not annualized

Scroll over to view complete data

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Investor Class | 11.32 | 7.38 | 8.16 | 9.80 | 11.49 | 16.26 | 15.98 | 15.98 | 2.61 |

| Value Institutional Class | 11.41 | 7.55 | 8.33 | 9.97 | 11.65 | 16.45 | 16.17 | 16.17 | 2.64 |

| Russell 2000® Value | 10.5 | 7.40 | 8.73 | 9.27 | 8.88 | 11.73 | 12.59 | 12.59 | 3.26 |

*Not annualized

| 2025 (%) | 2024 (%) | 2023 (%) | 2022 (%) | 2021 (%) | 2020 (%) | 2019 (%) | 2018 (%) | 2017 (%) | 2016 (%) | 2015 (%) | 2014 (%) | 2013 (%) | 2012 (%) | 2011 (%) | 2010 (%) | 2009 (%) | 2008 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Value Investor Class | 15.98 | 15.68 | 17.13 | -9.99 | 21.81 | 13.14 | 17.96 | -12.15 | 8.42 | 16.31 | -11.04 | 2.22 | 32.11 | 13.83 | -6.92 | 21.28 | 44.49 | -39.53 |

| Value Institutional Class | 16.17 | 15.88 | 17.31 | -9.91 | 21.96 | 13.31 | 18.14 | -11.98 | 8.59 | 16.52 | -10.90 | 2.38 | 32.37 | 13.98 | -6.73 | 21.50 | 44.86 | -39.38 |

| Russell 2000® Value | 12.59 | 8.05 | 14.65 | -14.48 | 28.27 | 4.63 | 22.39 | -12.86 | 7.84 | 31.74 | -7.47 | 4.22 | 34.52 | 18.05 | -5.50 | 24.50 | 20.58 | -28.92 |

12/31/2025

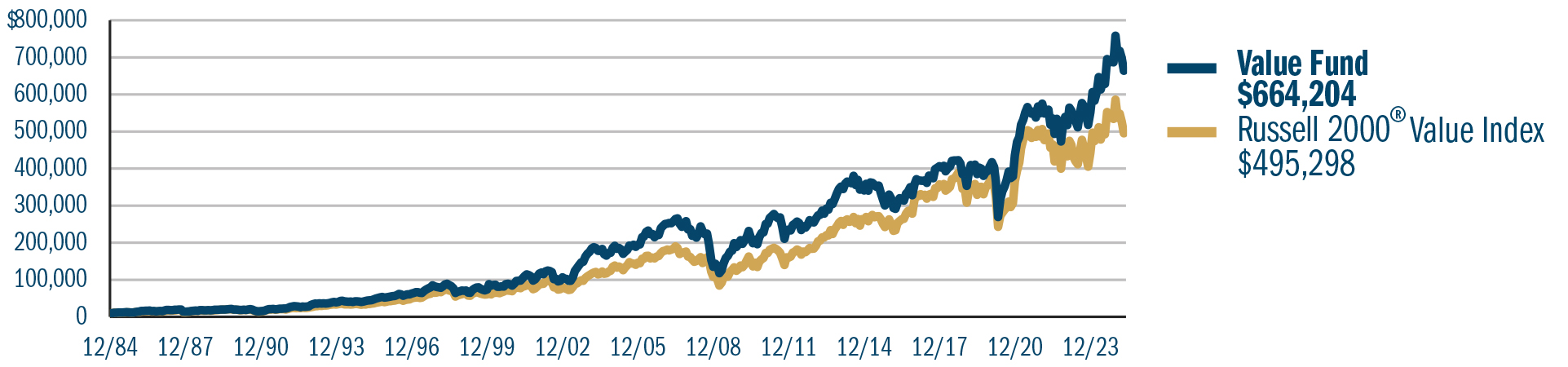

Since inception of the investor class, 12/28/1984 to 12/31/2025For the Since Inception period, the Russell 2000 Value Index data begins on 11/30/84

Chart represents a hypothetical example of an investment in the Value Fund representing historical returns

Based on risk-adjusted performance

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional classes of the Value Fund are 1.06% and 0.91%, respectively.

The inception date for the Value Fund is 12/28/1984 for the investor class and 5/1/2008 for the institutional class.

Contact a Relationship Manager for historical NAVs.

Historical NAVs also are available from third party websites, such as Bloomberg, Yahoo! Finance, or Google Finance.

12/31/2025

Scroll over to view complete data

| Characteristic | Value | Russell 2000® Value |

|---|---|---|

| Holdings | 102 | - |

| Assets | 887 million | - |

| Median Market Cap | 1.3 billion | 797 million |

| Weighted Average Market Cap | 2.5 billion | 3.5 billion |

| Trailing 1-Year Turnover | 43.7% | - |

12/31/2025

| Cap Range | % of Equities in Portfolio |

|---|---|

| >$15 billion | 0.0 |

| $2.5-15 billion | 37.4 |

| $500 million-2.5 billion | 48.8 |

| <$500 million | 13.8 |

The above breakdown does not include short-term investments.

12/31/2025

Source: FactSet Research Systems Inc., Russell Investment Group.

Scroll over to view complete data

| Ticker | Holding | % of Net Assets | Industry |

|---|---|---|---|

| CGAU | Centerra Gold, Inc | 3.2 | Metals & Mining |

| TCBI | Texas Capital Bancshares, Inc. | 2.9 | Banks |

| LINC | Lincoln Educational Services Corp. | 2.8 | Diversified Consumer Services |

| EGO | Eldorado Gold Corp. | 2.7 | Metals & Mining |

| SIMO | Silicon Motion Technology Corp. (ADR) | 2.4 | Semiconductors & Semiconductor Equipment |

| CCBG | Capital City Bank Group, Inc. | 2.2 | Banks |

| TFX | Teleflex Incorporated | 2.1 | Health Care Equipment & Supplies |

| VNOM | Viper Energy, Inc. | 2.0 | Oil Gas & Consumable Fuels |

| BBSI | Barrett Business Services, Inc. | 1.8 | Professional Services |

| ECPG | Encore Capital Group, Inc. | 1.7 | Consumer Finance |

| % of Total Net Assets | 23.7 | ||

12/31/2025

Scroll over to view complete data

| Alpha* | Standard Deviation (%)* | Beta | Info Ratio | Sharpe Ratio | Upside Capture (%)* | Downside Capture (%)* | R- Squared (%) | Active Share | |

|---|---|---|---|---|---|---|---|---|---|

| Value | 3.66 | 17.51 | 0.84 | 0.46 | 0.47 | 89.49 | 80.42 | 93.11 | 95.89 |

| Russell 2000® Value | 0.00 | 20.15 | 1.00 | 0.00 | 0.28 | 100.00 | 100.00 | 100.00 | 0.00 |

12/31/2025

Scroll over to view complete data

| Alpha* | Standard Deviation (%)* | Beta | Info Ratio | Sharpe Ratio | Upside Capture (%)* | Downside Capture (%)* | R- Squared (%) | Active Share | |

|---|---|---|---|---|---|---|---|---|---|

| Value | 3.81 | 17.52 | 0.84 | 0.49 | 0.48 | 89.81 | 80.24 | 93.09 | 95.89 |

| Russell 2000® Value | 0.00 | 20.15 | 1.00 | 0.00 | 0.28 | 100.00 | 100.00 | 100.00 | 0.00 |

*Annualized

Source: FactSet Research Systems Inc., Russell Investment Group

Alpha, beta, and information ratio are versus the Russell 2000® Value. Depiction is for investor and institutional class shares.

| Record Date |

Payable Date |

Ordinary Dividend ($/share) |

Short-Term Capital Gain ($/share) |

Long-Term Capital Gain ($/share) |

|

|---|---|---|---|---|---|

| 12/18/2025 | 12/19/2025 | 0.31248 | 0.05228 | 4.34950 | |

| 12/19/2024 | 12/20/2024 | 0.38807 | - | 3.86958 | |

| 12/26/2023 | 12/27/2023 | 0.33420 | - | 2.20840 | |

| 12/27/2022 | 12/28/2022 | 0.16583 | - | 1.05268 | |

| 12/28/2021 | 12/29/2021 | 0.07773 | 1.52971 | 4.66088 | |

| 12/28/2020 | 12/29/2020 | 0.13920 | - | 0.18973 | |

| 12/26/2019 | 12/27/2019 | 0.11058 | - | 1.09276 | |

| 12/27/2018 | 12/28/2018 | 0.06214 | 0.28550 | 2.09926 | |

| 12/27/2017 | 12/28/2017 | 0.04117 | - | 2.60800 | |

| 12/28/2016 | 12/29/2016 | - | - | 1.43802 | |

| 12/28/2015 | 12/29/2015 | 0.13994 | - | 2.82914 | |

| 12/29/2014 | 12/30/2014 | 0.22288 | 1.11429 | 4.12240 | |

| 12/26/2013 | 12/27/2013 | 0.42958 | 1.17103 | 3.98433 | |

| 12/26/2012 | 12/27/2012 | - | 0.17740 | 2.74405 | |

| 12/28/2011 | 12/29/2011 | - | 0.675954 | 1.798273 | |

| 12/28/2010 | 12/29/2010 | - | 0.058470 | - | |

| 3/28/2008 | 3/31/2008 | - | - | 0.084234 | |

| 12/26/2007 | 12/27/2007 | 0.239182 | 0.710262 | 5.923943 |

No distributions were paid in 2009.

| Record Date |

Payable Date |

Ordinary Dividend ($/share) |

Short-Term Capital Gain ($/share) |

Long-Term Capital Gain ($/share) |

|

|---|---|---|---|---|---|

| 12/18/2025 | 12/19/2025 | 0.39692 | 0.05228 | 4.34950 | |

| 12/19/2024 | 12/20/2024 | 0.46938 | - | 3.86958 | |

| 12/26/2023 | 12/27/2023 | 0.41519 | - | 2.20840 | |

| 12/27/2022 | 12/28/2022 | 0.21142 | - | 1.05268 | |

| 12/28/2021 | 12/29/2021 | 0.13924 | 1.52971 | 4.66088 | |

| 12/28/2020 | 12/29/2020 | 0.19383 | - | 0.18973 | |

| 12/26/2019 | 12/27/2019 | 0.17769 | - | 1.09276 | |

| 12/27/2018 | 12/28/2018 | 0.13454 | 0.28550 | 2.09926 | |

| 12/27/2017 | 12/28/2017 | 0.12267 | - | 2.60800 | |

| 12/28/2016 | 12/29/2016 | - | - | 1.43802 | |

| 12/28/2015 | 12/29/2015 | 0.20977 | - | 2.82914 | |

| 12/29/2014 | 12/30/2014 | 0.30599 | 1.11429 | 4.12240 | |

| 12/26/2013 | 12/27/2013 | 0.50608 | 1.17103 | 3.98433 | |

| 12/26/2012 | 12/27/2012 | - | 0.17740 | 2.74405 | |

| 12/28/2011 | 12/29/2011 | - | 0.675954 | 1.798273 | |

| 12/28/2010 | 12/29/2010 | - | 0.058470 | - |

No distributions were paid in 2008 and 2009.

100 years of industry experience

76 years of experience at Heartland

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

The Value Fund primarily invests in small companies selected on a value basis. Such securities generally are more volatile and less liquid than those of larger companies.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

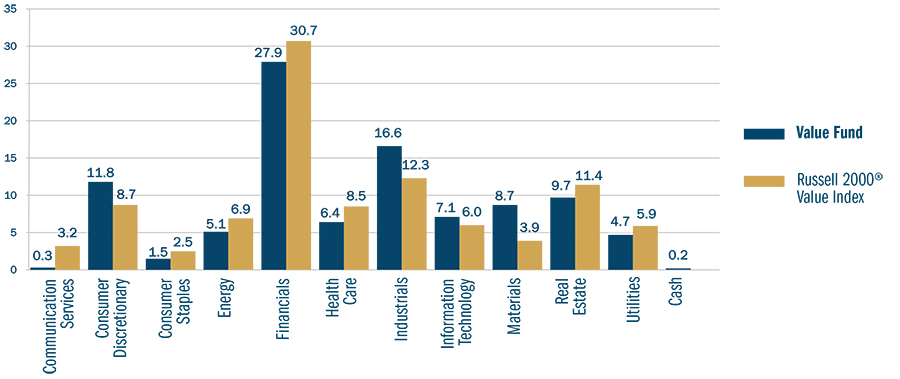

Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

The portfolio may lose value in various market conditions and an investor could have a loss of principal.

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

Portfolio holdings exclude cash, cash equivalents, options, and futures.

Certain security valuations and forward estimates are based on Heartland Advisors' calculations. Certain outliers may be excluded. Any forecasts may not prove to be true.

Information about Morningstar Ratings™ are ©2026 Morningstar, Inc. All rights reserved. The information contained herein is (1) proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed, and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

The Fund’s performance information included in regulatory filings includes a required index that represents an overall securities market (Regulatory Benchmark). In addition, the Fund's regulatory filings may also include an index that more closely aligns to the Fund's investment strategy (Strategy Benchmark(s)). The Fund's performance included in marketing and advertising materials and information other than regulatory filings is generally compared only to the Strategy Benchmark.

There is no guarantee that a particular investment strategy will be successful.

Heartland’s investing glossary provides definitions for several terms used on this page.

Unless noted with an asterisk (*), the above individuals are registered representatives of ALPS Distributors, Inc.

CFA® is a registered trademark owned by the CFA Institute.

The Heartland Funds are distributed by ALPS Distributors, Inc.

Separately managed accounts and related investment advisory services are provided by Heartland Advisors, Inc., a federally registered investment advisor. ALPS Distributors, Inc., is not affiliated with Heartland Advisors, Inc.