Was it surprising that risk-taking returned to the market in the second quarter, just a few months after a series of bank failures in March seemed to scare investors straight? Not really. Denial is a natural phase in the investment cycle, coming after delusion but preceding capitulation and despair.

Last quarter, investors chose to overlook a long list of nagging problems, including the Federal Reserve’s still-restrictive monetary policy, 6-month T-bills yielding 5.4% — tough competition for equities — and the 14th consecutive monthly decline in the Leading Economic Indicators.

On top of this, investors — who’ve been in a frenzy over artificial intelligence-related stocks — are holding out hope that the Federal Reserve isn’t simply done tightening, but that rate cuts could be just around the corner. In that case, they figured, the same playbook that worked in previous easing cycles might be useful again, with high-beta and low-quality stocks outperforming, which is what took place in the second quarter. The S&P 500® index was up almost 17% for the year, with the technology sector returning more than 42%.

What these investors are forgetting is that in the event the central bank is ready to take its foot off the brakes and tap the accelerator — still a big if — lenders are picking up where policy makers may be leaving off. Banks are hunkering down, tightening their lending standards while cutting back on loan issuance.

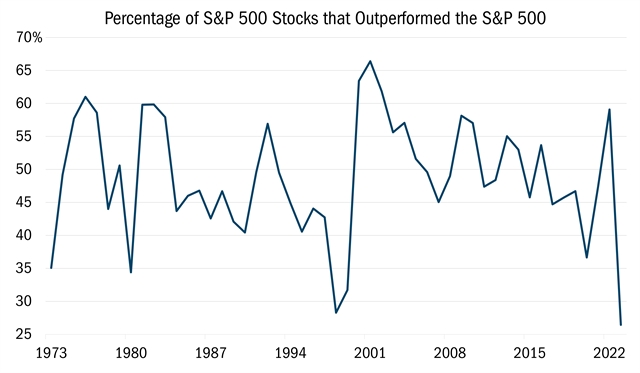

Meanwhile, there’s no denying that the breadth of this market is as narrow as it’s been in recent memory. So far this year, a smaller percentage of stocks are beating the benchmark than was the case in the run up to the global financial crisis, the dotcom crash, and the early ’80s recessions (see chart below).

Source: Ned Davis Research, yearly data from 12/31/1973 to 12/31/2022 and partial year data from 1/1/2023 to 6/22/2023. This chart represents the percentage of S&P 500® Stocks that outperformed the S&P 500® over the calendar year. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

In fact, just seven companies — the so-called Magnificent 7: Apple, Alphabet, Tesla, Amazon, Microsoft, Meta and Nvidia — account for the vast majority of year-to-date gains. And the five biggest names in the S&P 500® account for almost 23% of the entire benchmark. Historically, the market cap share of the Top Five has stood at around 13%.

Why is this important? Historically, narrow markets tend to be associated with poor performance while wide breadth is correlated with strong price gains in the 12 months after the fact. No wonder one of Robert Farrell’s famous rules for investing is that the “markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

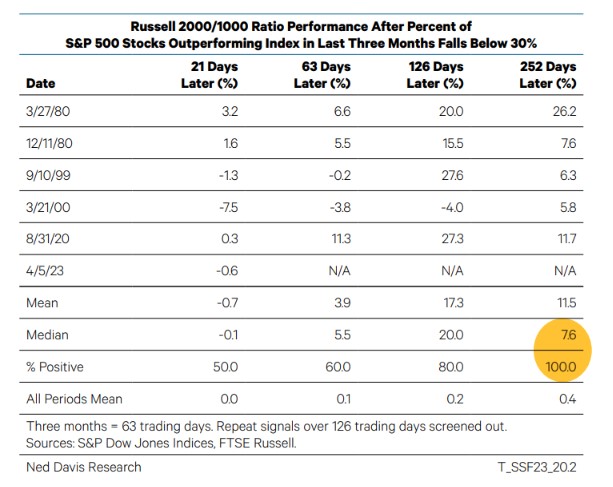

The good news is, there is a corollary to this rule — one that signals hope for patient, value-minded investors who focus on small-cap names. Ned Davis Research examined past periods in which the market’s breadth narrowed — specifically, when fewer than 30% of the stocks in the S&P 500® were beating the benchmark. It found that in the 12 months following those instances, small stocks outperformed large stocks every time.

Source: Ned Davis Research, daily data from 3/27/1980 to 5/31/2023. This chart represents the Russell 2000® to 1000® ratio performance after the percent of S&P 500® stocks outperforming index in last three months falls below 30%. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

The market’s advance, fueled by P/E expansion, the allure of AI stocks, and the hope for imminent Federal Reserve rate cuts, in our view is destined to disappoint. What will it take for investors to see these risks and to focus on the fundamentals and valuations again? We believe this will happen once the markets begin to price in growing credit and solvency risks that are materializing as the effects of Federal Reserve actions take hold.

Attribution Analysis & Portfolio Activity

This was a challenging quarter in a difficult year. While the NASDAQ Composite Index was up more than 30% year to date, the Russell 2000® Value Index was only up 2.5%. In the second quarter, 7 out of 11 sectors in the Russell 2000® Value Index posted gains.

The Heartland Value Fund also generated positive returns in 7 out of 11 sectors. As has happened in the past, stock selection provided a boost, allowing us to outperform the benchmark in Financials and Healthcare.

Although our performance was consistent with the benchmark, we lagged in the tech-heavy broader markets. Yet our approach in these moments is to be patient and add to holdings with attractive risk/reward characteristics and that fit our 10 Principles of Value Investing.™ We remain focused on uncovering businesses with strong leadership and resilient balance sheets offering compelling valuations.

Below are three new additions that are examples of taking what the market is giving us:

Consumer Discretionary. Mohawk (MHK) is a new position that represents a perfect example of a stock that has “come to us.” A leading manufacturer of flooring including carpets, tiles, and wood and vinyl products for the residential and commercial markets, Mohawk ran into stiff headwinds in recent years owing to high inflation in its source materials. This compressed their margins, and the stock price was nearly cut in half between June 2021 and early this year.

We believe the worst of those pricing pressures are largely behind the business, which stands to benefit from several trends, including ongoing growth in home remodeling; the anticipated reacceleration of existing home sales once rates begin to stabilize; and office space conversions as the commercial real estate market struggles with hybrid work. We purchased the shares when they were selling at around 6 times our estimated 2024 earnings, even though the stock has historically traded at a P/E of 15.

Technology. Electronic manufacturing services companies, like Benchmark Electronics (BHE), tend to do well in terms of profit and sales growth when times are good but poorly when times are bad, owing in part to their significant fixed cost overhead.

Though management has shifted its production mix away from lower-margin and slower-growth segments (like advanced computing) and toward higher-margin and faster-growth areas (like semi-cap equipment), BHE’s margins failed to deliver during the recent downturn in the semiconductor cycle. Moreover, recent moves to expand capacity to help customers “re-shore” manufacturing were not fully scaled, further weighing on margins. This short-term disappointment caused the stock to sell-off sharply and approach our downside target, creating a compelling entry point.

We believe management has now positioned the business in segments that will allow for above-average industry growth and margin expansion. BHE trades at 12 times 2023 earnings and 10 times 2024 profits. By comparison, industry peers with similar growth and margin expansion opportunities are trading at P/E ratios (based on 2024 earnings) in the low- to mid-teens.

Industrials. Healthcare Services Group (HCSG) manages housekeeping, laundry, dining, and nutritional services within the healthcare market. The stock has come under pressure in recent years, as occupancy levels at their clients’ facilities plummeted during the global pandemic. Meanwhile, inflation in the aftermath of the pandemic disadvantaged HCSG’s contract pricing. We believe those headwinds have abated, as occupancy is improving, and the company is restructuring its contracts to include more dynamic pricing. There is also a significant opportunity to gain market share, as only 30% of skilled nursing facilities currently outsource their housekeeping.

Management’s efforts have guided EBITDA margins back to 6%. Today, HCSG sports a balance sheet that exceeds our expectations with net cash and strong free cash flow and trades at 0.6X enterprise value to sales. Yet when it was at this level of profitability in the past, the business was priced at 1.5X EV/Sales.

Outlook

This mega-tech-driven market has been challenging for small stock performance. Yet we believe this remains a constructive environment for Value investors who are disciplined. What you buy — and the price you pay — matters at the end of the day. We are focused on what the market is giving us, being extremely selective in identifying opportunities that can shine over the next market cycle, not just the coming quarter. Thank you for your continued trust and confidence.

Fundamentally Yours, The Heartland Team