See standardized performance at the end.

Hopes that the market is beginning to broaden out were largely confirmed in the fourth quarter, as small value stocks outpaced the majority of the Magnificent 7 and as the artificial intelligence (AI) trade suffered a November pullback amid growing concerns about overinvestment in the sector along with a reassessment of who the ultimate winners of this disruptive technology might be.

There were also fundamental factors driving widening market breadth, as small-cap earnings continued to gain strength. We expect profits for small companies to grow around 15% in 2026, slightly exceeding current forecasts for the S&P 500. If this materializes, it would be a meaningful development for an asset class that hasn’t had a lot of positive news relative to large caps since 2021.

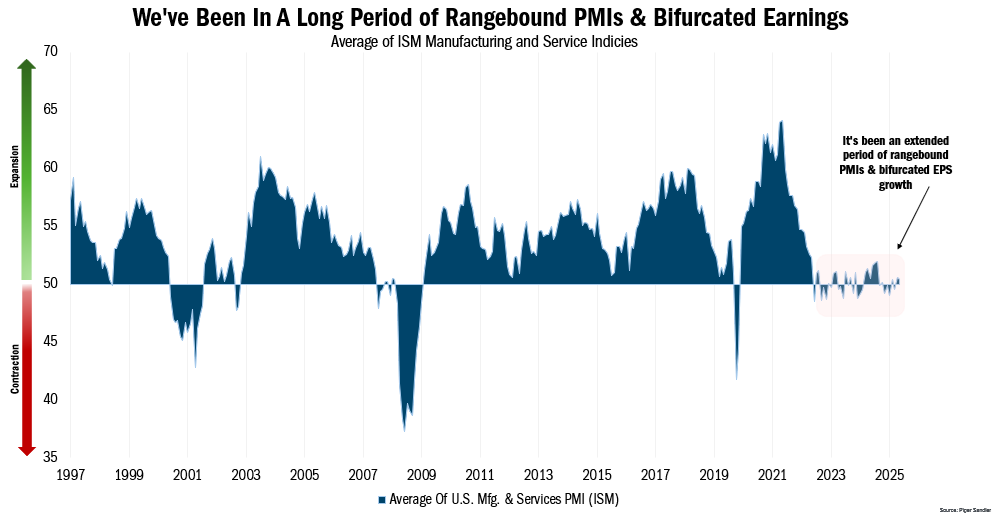

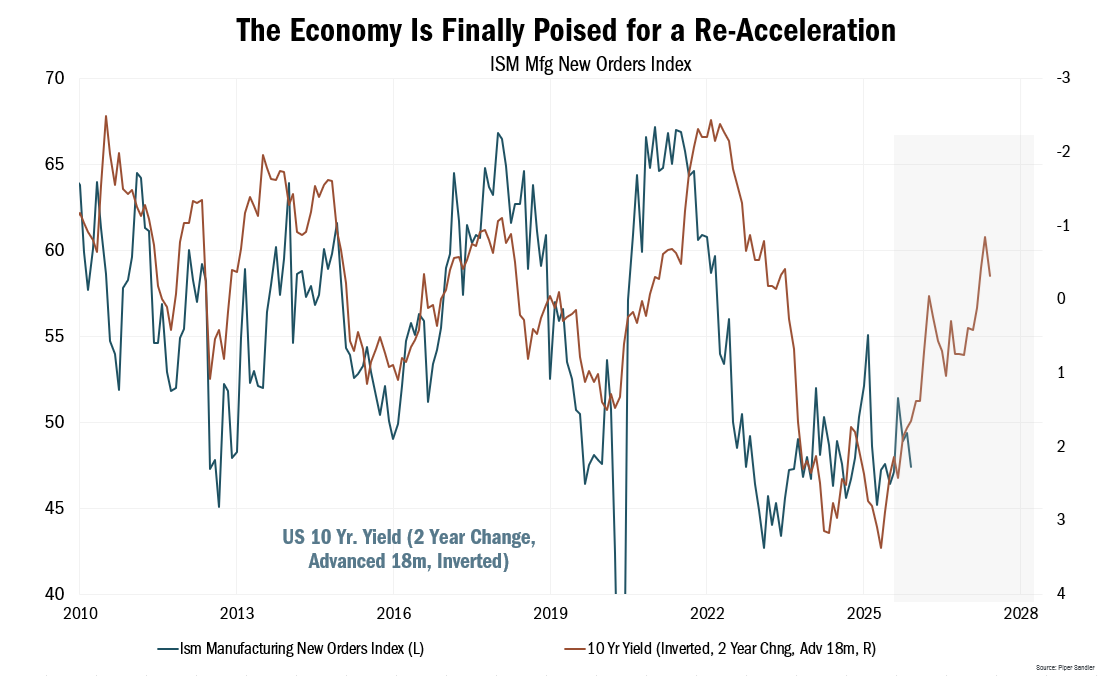

There’s yet more reason for optimism in this space. Industrial activity, as measured by the ISM Purchasing Managers’ Indexes (for both the manufacturing and services sectors), has been flat for several years, partly owing to high interest rates. The Federal Reserve’s move to cut short-term rates could spur demand, as economic activity and the PMI indexes have historically been highly correlated (see the chart below). Not only would an accelerating economy benefit smaller companies, the falling rates that are boosting growth in the first place generally disproportionately help small caps, as emerging businesses are more sensitive to refinancing costs.

Source: FactSet Research Systems Inc. via Piper Sandler & Co., Monthly data from 7/31/1997 to 11/28/2025. This chart shows the average of the ISM Manufacturing and ISM Services indices. ISM Manufacturing PMI (Purchasing Managers Index) is an index based on surveys of more than 400 manufacturing firms by the Institute for Supply Management (ISM). The PMI index is an indicator of the economic health of the manufacturing sector based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. A reading over 50 represents that the industry is expanding, under 50 represents a contraction, while a reading at 50 represents no change. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Source: FactSet Research Systems Inc. via Piper Sandler & Co, Monthly data from 1/31/2010 to 11/30/2025. This chart shows the ISM Manufacturing New Orders index being led by 18 months by the 2-year change in the 10-year yield (also inverted on the chart). ISM Manufacturing New Order Index is an index based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The New Orders Index compares current month orders with the prior month. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Although the economy isn’t going full tilt just yet, labor market concerns persist. Still, it feels like things aren’t getting worse in many parts of the market, which is a welcome change. In this ‘K-shaped’ recovery in which high-net-worth households have been thriving while working class consumers have been struggling, we’re at least seeing signs that lower-end consumer demand is starting to stabilize.

That’s all promising from a top-down perspective. At Heartland, our 10 Principles of Value Investing™ require us to make portfolio decisions from the bottom-up, based on fundamentals such as attractive valuations, quality balance sheets, and sound business strategies, among other factors. On this count, we are equally optimistic, as we continue to see opportunities in this market.

The Value Plus Strategy was down 0.10% in the fourth quarter, compared with the 3.26% gain for the Russell 2000® Value Index. Our stock selection was positive in several sectors led by Information Technology and Real Estate which accounted for some of our top-performing holding in the quarter. By contrast, the selection effect was negative in Health Care, Industrials, and Energy.

Health Care represented a significant portion of our Strategy’s negative selection effect in the quarter, but that was largely driven by stocks we didn’t own, as opposed to those we held in the portfolio. Health Care represents roughly 10% of the Russell 2000® Value Index, and a good portion of that exposure in the benchmark comes from biotech companies, which in October and November rose more than 20%. However, that’s a group where we don’t have any direct exposure, as many small-cap companies are still years from turning a profit.

Not owning biotech certainly hurt our performance relative to our benchmark, but that’s a decision we’re comfortable making, as our security selection process is driven by our 10 Principles of Value Investing™, which requires us to focus on fundamental factors including positive earnings dynamics. The good news is that Health Care is one of the areas where we’re seeing promising opportunities.

We have also been seeing positive signs in areas of the market that touch consumers. One of the top contributors to our Strategy’s performance in the quarter, for instance, was Lamar Advertising (LAMR), the nation’s leading out-of-home advertising company. LAMR, which operates as a real estate investment trust, had been underperforming for much of the year. It recently provided a solid Q3 report and very favorable outlook causing the stock to rally.

When it comes to stock selection, we like to see improving fundamentals confirmed by actions of management through active share buybacks, insider buying, and growing dividends. These are all signs of management’s confidence in the future profits and cash flows of their respective companies. A majority of the companies in our portfolio are active in at least two of these three focus areas. LAMR is one of these companies, as the company has been active on its buyback program and increased its dividend this year.

LAMR’s pacings have been strong, which should lead to positive earnings growth in 2026. Even better, 2026 brings with it the mid-term election cycle, which should boost political advertising spending on Lamar’s properties. Still, the stock trades at a reasonable valuation of around 15 times 2026 Enterprise Value/EBITDA.

Another overlooked stock with the notable upside potential in 2026 is WESCO International (WCC), a logistics and supply chain solutions company in which we initiated a new position during the quarter.

Shares of WESCO, which connects suppliers and customers around the world for electrical, industrial, utility, and communications products, had been underperforming the Industrial sector in 2024 and the first half of 2025. That was largely due to double-digit declines in its Utility and Broadband Solutions segment as well as the ongoing slowdown in its Electrical & Electronic Solutions segment. EBITDA margins declined during this period, but they appear to be set to expand going forward as we expect WCC to return to mid-single-digit growth rates within both segments. We also expect WESCO’s EBITDA margins to improve from an expected 6.6% in FY 2025, thanks in part to cost savings from prior investments in automation.

With improving growth prospects and a healthy potential to expand EBITDA margins, WCC could offer double-digit EPS growth for several years to come. Yet the stock trades at less than 1 times FY 2027 sales and around 10 times EBITDA.

Builders FirstSource (BLDR) was one of the biggest detractors in the quarter, but one where we have continued faith. BLDR is the largest distributor of lumber and building products materials for contractors and home builders. The company has been a consolidator of smaller regional lumberyards over time and made a push towards increasing value-add building products such as pre-assembled trusses to save builders time and labor on the job site.

Housing starts weakened in 2025 as high interest rates cooled housing demand amid decreased housing affordability and an oversupply of new homes. Many of these markets have been hot coming out of the pandemic. As a result, BLDR earnings and estimates have been revised lower, and the stock is down nearly 40% since late January.

We believe it’s early days in the housing market’s cyclical recovery and fundamental improvement. Moreover, BLDR’s chairman bought $55 million of stock in the summer. The company has also been a consistent acquirer of its own shares through buybacks, so the business checks two of the three capital allocation boxes we look for.

The company should have considerable EPS upside when housing fundamentals improve, which is more likely now as interest rates are falling. We believe housing starts are likely to normalize back to long-term averages, as the country is in dire need of more housing supply. Management has said it believes the business can generate $2.1 billion to $2.4 billion of EBITDA in a normalized housing start environment. Even if we take the low-end of that range, that still represents very strong upside. Yet the stock trades at less than 11 times EBITDA.

The good news is, the market appears to be broadening out, giving small-cap investors reason for hope. While earnings growth and demand dynamics are improving, we don’t believe this is the time to focus on the macro. Instead, this is an opportunity for fundamentally driven investors like us to seek out well-run businesses with strong self-help and capital allocation plans in place that are well-positioned to take advantage of the economic tailwinds that are forming. We also want to build in a margin of safety, which comes from our 10 Principles of Value Investing™, which directs us to undervalued companies with low debt, positive earnings dynamics, and competitive advantages that are useful against any backdrop.

Thank you for your continued trust and confidence in us.

Scroll over to view complete data

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Plus Investor Class | 9.00 | 6.86 | 5.93 | 7.65 | 4.01 | 0.86 | 1.06 | 1.06 | -0.36 |

| Value Plus Institutional Class | 9.14 | 7.09 | 6.19 | 7.89 | 4.27 | 1.13 | 1.30 | 1.30 | -0.30 |

| Russell 2000® Value | 9.35 | 7.40 | 8.73 | 9.27 | 8.88 | 11.73 | 12.59 | 12.59 | 3.26 |

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Plus Fund is 10/26/1993 for the investor class and 5/1/2008 for the institutional class.

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional class of the Value Plus Fund are 1.21% and 0.94%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the institutional class, to the extent necessary to maintain the institutional class’ “Net Annual Operating Expenses” at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional class of the Value Plus Fund are 1.21% and 0.94%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the institutional class, to the extent necessary to maintain the institutional class’ “Net Annual Operating Expenses” at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information may be found in the Funds' prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing.

As of 12/31/2025, Builders FirstSource (BLDR), Lamar Advertising Co. (Class A) (LAMR), and WESCO International, Inc. (WCC) represented 1.80%, 3.22% and 1.71% of the Value Plus Fund’s net assets, respectively.

Statements regarding securities are not recommendations to buy or sell.

Portfolio holdings are subject to change. Current and future holdings are subject to risk.

The Value Plus Fund invests in small companies that are generally less liquid and more volatile than large companies. The Fund also invests in a smaller number of stocks (generally 40 to 70) than the average mutual fund. The performance of these holdings generally will increase the volatility of the Fund’s returns.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The Value Plus Fund seeks long-term capital appreciation and modest current income.

The Fund’s performance information included in regulatory filings includes a required index that represents an overall securities market (Regulatory Benchmark). In addition, the Fund's regulatory filings may also include an index that more closely aligns to the Fund's investment strategy (Strategy Benchmark(s)). The Fund's performance included in marketing and advertising materials and information other than regulatory filings is generally compared only to the Strategy Benchmark.

The above individuals are registered representatives of ALPS Distributors, Inc.

The Heartland Funds are distributed by ALPS Distributors, Inc.

The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

There is no guarantee that a particular investment strategy will be successful.

Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Because of ongoing market volatility, performance may be subject to substantial short-term changes.

Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

In certain cases, dividends and earnings are reinvested.

There is no assurance that dividend-paying stocks will mitigate volatility.

CFA® is a registered trademark owned by the CFA Institute.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group.

Data sourced from FactSet: Copyright 2025 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved.

Artificial intelligence (AI) is intelligence perceiving, synthesizing, and inferring information demonstrated by computers, as opposed to intelligence displayed by humans or by other animals. Bottom-up is an investment approach that de-emphasizes the significance of economic and market cycles. This approach focuses on the analysis of individual stocks and the investor focuses his or her attention on a specific company rather than on the industry in which that company operates or on the economy as a whole. Buyback is the repurchase of outstanding shares (repurchase) by a company in order to reduce the number of shares on the market. Cyclical Stocks cover Basic Materials, Capital Goods, Communications, Consumer Cyclical, Energy, Financial, Technology, and Transportation which tend to react to a variety of market conditions that can send them up or down and often relate to business cycles. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) measures a company’s financial performance. It is used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. Enterprise Value (EV) is the entire economic value of a company. Insider Buying is the purchase of a company's stock by individual directors, executives or other employees. Margin of Safety is a principle of investing in which an investor only purchases securities when the market price is significantly below its intrinsic value. The ISM Purchasing Manager's Index (PMI) is a key economic indicator that gauges the health of the manufacturing sector in the United States, based on a monthly survey of purchasing and supply executives. ISM Manufacturing PMI (Purchasing Managers Index) is an index based on surveys of more than 400 manufacturing firms by the Institute for Supply Management (ISM). The PMI index is an indicator of the economic health of the manufacturing sector based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. A reading over 50 represents that the industry is expanding, under 50 represents a contraction, while a reading at 50 represents no change. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Russell Investment Group. Russell 2000® Index includes the 2000 firms from the Russell 3000® Index with the smallest market capitalizations. All indices are unmanaged. It is not possible to invest directly in an index. Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price/book ratios and lower forecasted growth characteristics. All indices are unmanaged. It is not possible to invest directly in an index. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. Selection Effect of the Attribution Analysis is the portion of the portfolio excess return attributable to choosing different securities within groups from the benchmark. 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.

Heartland’s investing glossary provides definitions for several terms used on this page.