See standardized performance at the end.

While the second quarter proved to be another challenging period for small stocks, we are increasingly optimistic that the backdrop is improving. What gives us this sense?

Though the Russell 2000® Index lagged the S&P 500 Index in the three months ended June 30, that gap started to close at the end of April, as investors’ fears over tariff-induced demand destruction seemed to ease. The headlines surrounding the potential impact of a global trade war remain unsettling, but many investors are beginning to believe the fallout may be less severe than originally anticipated. At the very least, based on reports in recent earnings calls, agile small companies with less complicated supply chains than large multinationals appear to be coping and adjusting more effectively.

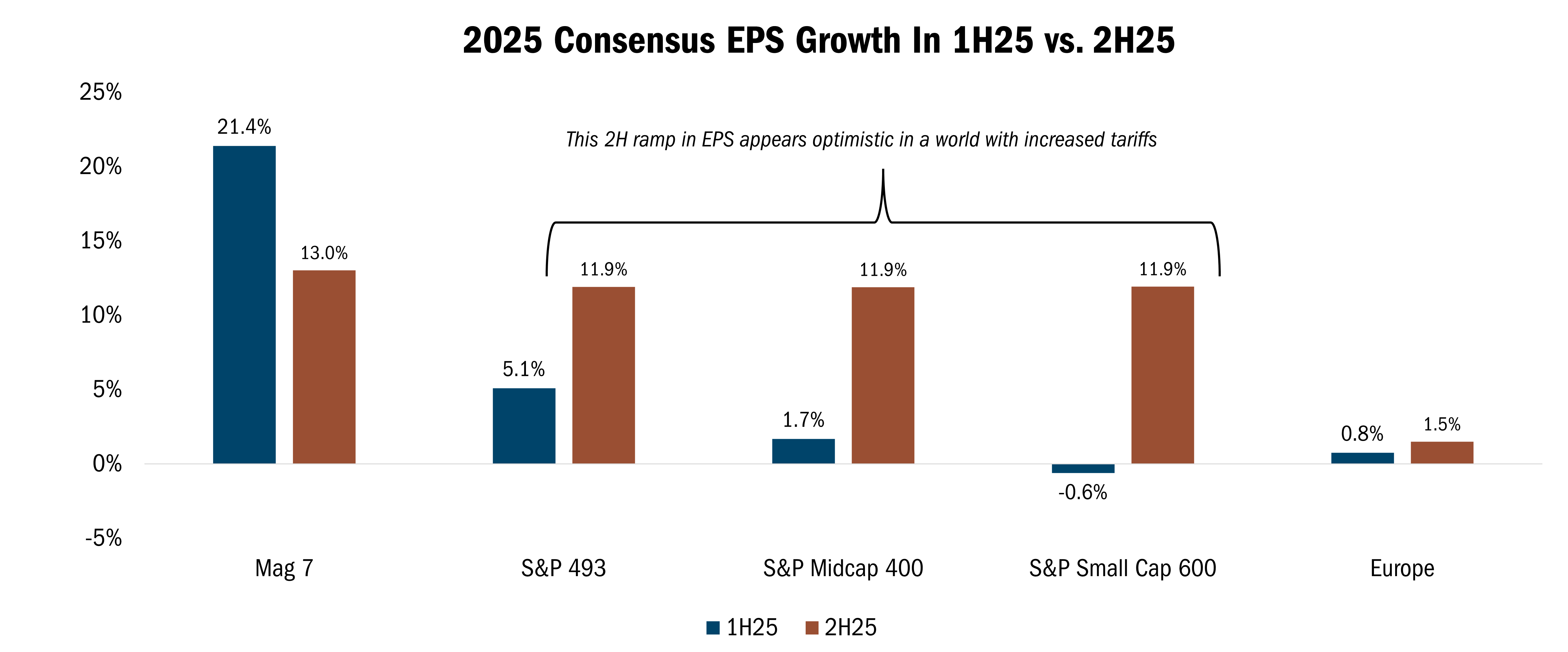

The profit outlook for small caps is also expected to improve significantly in the second half of this year. While earnings for companies in the S&P 600 Index of small stocks were largely flat in the first six months of the year, compared with the same period a year earlier, profit growth is expected to jump 11.9% in the second half. Should that materialize, small-cap earnings growth would largely be in line with the broad market, including the Magnificent 7, whose earnings are slowing noticeably (see the chart below).

Source: FactSet Research Systems Inc., quarterly data from 3/31/2021 to 12/31/2025. This chart represents the 2025 Consensus ESP Growth in 1H25 versus 2H25. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

There are several factors that may help explain the sudden turn, including small companies’ relatively lower exposure to tariffs, owing to the greater domestic orientation of their sales and production. Another explanation could be cyclical. While S&P 500 earnings troughed in 2023 and have been improving ever since, small-cap profit margins are only now beginning to recover. The anticipated acceleration later this year reflects the fact that small-company earnings are finally beginning to catch up.

Furthermore, the S&P 500’s exposure to the Technology sector is roughly twice that of the Russell 2000® while its weighting in Industrials is about half as large. Tech has been a big beneficiary of accelerating capex spending in recent years, but that growth seems to be moderating while investments in the Industrials sector are expected to grow.

Add to this the fact that many small companies are growing increasingly confident in their ability to navigate policy uncertainties, as evidenced by share buybacks, dividend increases, and insider buying activity. Within our portfolio, we’ve seen insider buying at approximately 36% of our holdings, sending us a positive signal for future performance.

There is one caveat, however. In the most cyclical parts of the market, low-margin companies dependent on high volumes with little pricing power are still facing a tough slog. That’s why we must be discerning. For us, that starts with our 10 Principles of Value Investing™, which guides us to attractively priced, financially sound, and well-run businesses with positive earnings dynamics. On top of that, we continue to look for companies that aren’t simply waiting around for demand dynamics to improve — they are making strategic, operational, and structural improvements to reduce costs and improve margins regardless of how the economy unfolds.

The Value Plus Fund gained 1.86% in the second quarter, compared with the 4.97% gain for the Russell 2000® Value Index. Stock selection, which was responsible for most of the underperformance, was positive in just two sectors: Health Care and Financials. Those segments accounted for two of the eight biggest contributors to our Strategy’s returns over the past three months.

During the quarter, we made a conscious decision to pivot away from cyclical, volume-dependent businesses waiting for demand dynamics to improve. Instead, a key focus of our selectivity recently has been driven by self-help strategies that could lead to margin improvements regardless of the economic backdrop.

These are companies like Gates Industrial Corporation plc (GTES), a leading manufacturer of belts and hoses used in vehicles and industrial machines. Following President Trump’s “Liberation Day” tariff announcement, small-cap Industrials sold off on fears of potential demand destruction. Gates wasn’t immune. The stock tumbled more than 19% between April 2 and the market’s trough on April 8, compared with the 14% decline for the S&P 600 Industrial Index. We saw this as an opportunity because we believe Gates is well positioned relative to the average small cap Industrial.

Why? Gates mostly produces in North America for U.S. customers, meaning they do less importing and exporting from Asia than their peers. That’s not to say the company is without tariff exposure. But Gates enjoys pricing power, as most of its parts are mission critical to customers, who have no choice but to replace belts and hoses that break. The company’s customers are also purchasing fewer new machines while holding onto their existing equipment longer, increasing the odds of belts and hoses wearing out. That’s good news for GTES, since 68% of the company’s revenues come from replacement of parts.

Gates has been undergoing a continual cost reduction and footprint optimization program lately that we believe will help protect margins on the downside from a decline in volume. That view was confirmed in the first quarter, when Gates maintained its full-year guidance, signaling that tariffs would be neutral to management’s EBITDA projections. The company hopes to blunt the effect of tariffs through price increases and cost savings from its self-help efforts.

Gates shares have bounced back more than 45% since April 8, versus around a 28% gain for its S&P 600 Industrial peers. Still, the stock trades at just 14 times earnings and 10 times EBITDA, which is relatively low compared to other Industrial businesses with a similar margin profile.

Silicon Motion Technology Corp. (SIMO) — a leading maker of memory components used in PCs, smartphones, data centers, and industrial applications — also took a hit earlier this year, on tariff concerns and as investors questioned the capex needs of large-scale cloud service providers known as hyperscalers. SIMO shares sank more than 30% from March 24 to April 21, on fears that further weakness in consumer spending could impact PC and smartphone sales. Since then, however, hyperscalers have confirmed robust datacenter capex growth, as consumer sentiment has rebounded somewhat. Since April 21, SIMO shares have surged more than 70%.

We continue to hold SIMO because we believe it is in the early days of a re-rating from its upcoming growth and margin expansion as data center products evolve to become a larger percentage of the company’s total revenue mix. Silicon Motion has historically leaned more to the consumer electronics side of the business, which is marked by trailing edge technology and lower margins. However, throughout the recent downcycle the company made a push into higher-margin, leading-edge applications driven by hyperscaler demand. On its last earnings call, management announced it was partnering with Nvidia on memory storage banks.

Due to the longer-than-usual down cycle for consumer electronics companies, though, our analysis indicates that SIMO remains meaningfully undervalued. The stock currently trades at $75.17 a share, but we believe the company should be valued at $90. That’s based on a 13X EBITDA multiple plus an anticipated $160 million cash settlement from SIMO’s ongoing arbitration with MaxLinear surrounding the termination of a proposed merger agreement two years ago.

On paper, Envista Holdings Corp. (NVST), a leading supplier of dental equipment, consumables, and services, could be vulnerable when household budgets are tightening. Indeed, NVST’s core product, dental implants, can see associated procedures postponed as consumers prioritize more essential financial needs. Not surprisingly, NVST lost a third of its value from February 18 through April 8, when economic slowdown fears began to emerge.

However, worries over demand destruction proved to be overblown. While NVST’s revenues declined 1.1% year over year in the first quarter, that was better than feared as demand remained solid across its product lines and management provided an upbeat outlook for the full year. Further fueling confidence: Management initiated the company’s first share buyback in history, purchasing $15 million worth of stock at around $17 per share. That was roughly the same price at which the CEO and CFO had purchased shares in the open market last year, another encouraging sign.

The company has undertaken internal initiatives to mitigate tariff pressures and expand margins. Recently, Envista began shifting the manufacturing of its premium implants for the Chinese market from the U.S. to Sweden while adding additional suppliers to diversify its supply chain. Envista is a great illustration that even though tariff pressures remain real, many small businesses are nimble enough to change course and adjust quickly.

Despite the positive attributes noted above, NVST is trading at a modest 8.5x EBITDA, while sporting around a 5% Free Cash Flow/Enterprise Value Yield and low leverage of just 0.6x Net Debt/EBITDA. This represents a material discount to Envista’s historic and recent earnings multiple.

The message of the second quarter was clear: Initial fears over tariff-induced demand destruction were likely overblown. At the very least, many small companies have proven to be agile and smart enough to make key adjustments to protect their margins. Combine that with dividend increases, buyback activity, and insider buying, and we believe there is cause for small-cap investors to be optimistic. While we are being opportunistic, we are also mindful of the need to temper that optimism with some caution as policy uncertainties remain. This is why we are leaning into companies taking self-help steps to protect and improve their margins regardless of the demand outlook. As always, we are also being guided by our 10 Principles of Value Investing, which aim to create a margin of safety by focusing on undervalued companies with low debt, high-quality balance sheets, and competitive advantages that are useful regardless of the health of the economy.

Thank you for your continued trust and confidence in us.

Scroll over to view complete data

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Plus Fund is 10/26/1993 for the investor class and 5/1/2008 for the institutional class.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

In the prospectus dated 5/1/2025, the Gross Fund Operating Expenses for the investor and institutional class of the Value Plus Fund are 1.21% and 0.94%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the institutional class, to the extent necessary to maintain the institutional class’ “Net Annual Operating Expenses” at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower.

Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com.

An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information may be found in the Funds' prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing.

As of 6/30/2025, Gates Industrial Corporation plc (GTES), Envista Holdings Corp. (NVST), and Silicon Motion Technology Corp. (ADR) (SIMO) represented 3.43%, 3.46% and 2.10% of the Value Plus Fund’s net assets, respectively.

Statements regarding securities are not recommendations to buy or sell.

Portfolio holdings are subject to change. Current and future holdings are subject to risk.

The Value Plus Fund invests in small companies that are generally less liquid and more volatile than large companies. The Fund also invests in a smaller number of stocks (generally 40 to 70) than the average mutual fund. The performance of these holdings generally will increase the volatility of the Fund’s returns.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The Value Plus Fund seeks long-term capital appreciation and modest current income.

The Fund’s performance information included in regulatory filings includes a required index that represents an overall securities market (Regulatory Benchmark). In addition, the Fund's regulatory filings may also include an index that more closely aligns to the Fund's investment strategy (Strategy Benchmark(s)). The Fund's performance included in marketing and advertising materials and information other than regulatory filings is generally compared only to the Strategy Benchmark.

The above individuals are registered representatives of ALPS Distributors, Inc.

The Heartland Funds are distributed by ALPS Distributors, Inc.

The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

There is no guarantee that a particular investment strategy will be successful.

Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Because of ongoing market volatility, performance may be subject to substantial short-term changes.

Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

In certain cases, dividends and earnings are reinvested.

There is no assurance that dividend-paying stocks will mitigate volatility.

CFA® is a registered trademark owned by the CFA Institute.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group.

Data sourced from FactSet: Copyright 2025 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved.

Buyback is the repurchase of outstanding shares (repurchase) by a company in order to reduce the number of shares on the market.

Cyclical Stocks cover Basic Materials, Capital Goods, Communications, Consumer Cyclical, Energy, Financial, Technology, and Transportation which tend to react to a variety of market conditions that can send them up or down and often relate to business cycles. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) measures a company’s financial performance. It is used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. Earnings Per Share is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings Yield is the reciprocal of the price to earnings ratio. Leverage is the amount of debt used to finance a firm's assets. A firm with significantly more debt than equity is considered to be highly leveraged. Free Cash Flow is the amount of cash a company has after expenses, debt service, capital expenditures, and dividends. The higher the free cash flow, the stronger the company’s balance sheet. Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. Net Debt/EBITDA Ratio is calculated as a company's interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA, and is a leverage measurement that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. If a company has more cash than debt, the ratio can be negative. Risk on/Risk off Theory is an investment setting in which price behavior responds to, and is driven by, changes in investor risk tolerance. Risk-on risk-off refers to changes in investment activity in response to global economic patterns. During periods when risk is perceived as low, risk-on risk-off theory states that investors tend to engage in higher-risk investments. When risk is perceived as high, investors have the tendency to gravitate toward lower-risk investments. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Russell Investment Group. Russell 2000® Index includes the 2000 firms from the Russell 3000® Index with the smallest market capitalizations. All indices are unmanaged. It is not possible to invest directly in an index. Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price/book ratios and lower forecasted growth characteristics. All indices are unmanaged. It is not possible to invest directly in an index. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. Upside Capture/Downside Capture vs. Market is a measure used to evaluate how well a manager or index performed (gained more or lost less) relative to another index during periods when that index rose or fell. Market is defined as the X Index. Net Debt/EBITDA Ratio is calculated as a company's interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA, and is a leverage measurement that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. If a company has more cash than debt, the ratio can be negative. 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.

Heartland’s investing glossary provides definitions for several terms used on this page.