As long-term fans of small caps, we couldn’t agree more with Lisa Shalett of Morgan Stanley Wealth Management. Heartland’s love and focus for more than 40 years has been researching small- and micro-caps in search of compelling valuations offering potential capital appreciation.

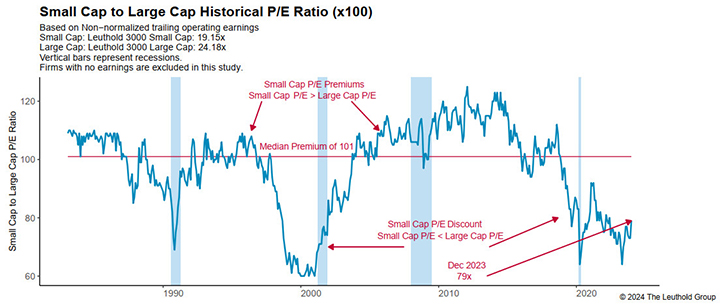

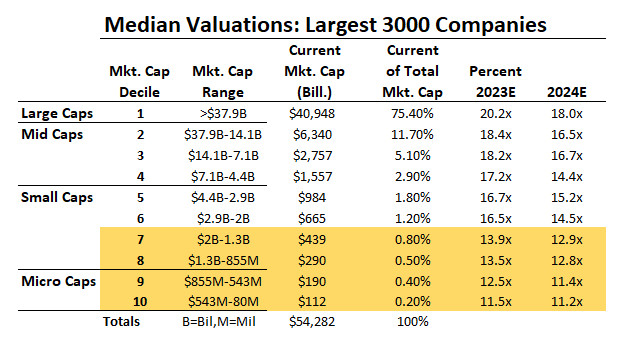

As seen in the table below from institutional research firm The Leuthold Group, LLC, small stocks are trading at a 21% discount to large. The Strategy, with a median market cap of approximately $1.2 billion, is squarely focused on the market segment labeled Deciles 7-10, which, on a price-to-earnings basis, is the cheapest part of the U.S. market. This is only the third time since 1980 that our universe has been this severely on sale.

Source: The Leuthold Group. Monthly data from 1/31/1983 to 12/31/2023. This chart represents Small Cap to Large Cap Historical Price/Earnings Ratio multiplied by 100. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Source: The Leuthold Group. This table represents Median Valuations across the largest 3000 companies categorized within Large Caps, Mid Caps, Small Caps, and Micro Caps. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

As value investors, we are betting on mean reversion and this disparity closing. That process might have begun. Since Oct. 27, the Russell 2000® Value Index has surged 24.6%, outpacing the S&P 500 as well as the Magnificent 7, the mega-cap tech stocks that accounted for much of the broad market’s gains in 2023.

What might be the catalyst to keep this going? Demand, for starters. Ms. Shalett, CIO of $6 trillion in assets, twice the size of the small-cap market, indicates she is fond of small value. Valuations, too, are supportive, with robust free cash flows and 10% earnings yields possible. In Federal Reserve Chairman Powell’s new world of lower interest rates, the Strategy priced at only 12X forward earnings looks compelling.

Attribution Analysis & Portfolio Activity

For the quarter, the Heartland Small Cap Value Strategy returned 7.4%, trailing the 15.3% gains for the Russell 2000® Value Index. Part of that is attributable to security selection in addition to the strong rally in early cycle sectors where we were underweight.

For the full year, the Strategy was up approximately 10% versus 14.7% for the benchmark. Throughout the year, we’ve done a decent job of taking what the market gives us and waiting for hanging curve balls to come over the plate.

A good example is UGI Corporation (UGI), an energy holding company that operates natural gas pipelines and regulated utilities in Pennsylvania and West Virginia while also distributing propane to residential and commercial customers through its AmeriGas and UGI International subsidiaries.

The overhang on UGI’s stock, which was nearly cut in half from February to October, has been the deteriorating EBITDA contributions from AmeriGas. After rolling up this business over the years, the company decided in 2021 to integrate all the acquisitions from a systems, distribution, and call center perspective. Unfortunately, they dropped the ball on execution, as customer retention was poor due to elevated driver turnover and overall poor service levels.

In late August, UGI announced a strategic review to evaluate all options for the business, which includes sticking with the turnaround plan which has showed two quarters of stabilization. CEO Roger Perreault, who led the initial transformation of AmeriGas, also announced he was stepping down. We think his departure is a positive for this undervalued energy company.

We initiated a position in this company in the fourth quarter as the stock was trading close to book value and just 7.5X earnings, for an earnings yield of 13.3%. By comparison, pipelines trade at over 16X forward earnings and utilities at 20X. Although UGI’s pipeline and propane businesses are more volatile than a traditional regulated utility, a dividend yield of over 6%, in our view, more than compensates.

Early last year, we highlighted Centerra Gold (CGAU), a producer of gold and copper. With the recent pivot by the Federal Reserve to an easy money policy, we thought an update of this underappreciated hard asset was timely.

Centerra continues to make progress in increasing production while lowering costs. During the third quarter, the Oksut mine restarted, resulting in earnings per share of $0.20 while throwing off cash flow in excess of $100 million. Centerra remains debt free with cash soaring to $492 million, or $2.28 per share. A new management team is focused on optimizing a diverse portfolio of assets, including a strategy to boost the value of its molybdenum business for eventual sale. With an admirable balance sheet, Centerra has the resources to fund an aggressive exploration program in North America, pay a 3.3% dividend, and embark on an 8.5% repurchase of shares outstanding.

Trading below stated book value, approximately 60% of NAV, and less than 3X EV/EBITDA, we believe Centerra remains an outstanding small cap value.

Outlook

The rebound in small value late in the quarter is a ray of sunshine. The wide disparity in valuations relative to large caps provides confidence that a meaningful transition will eventually take place, whether today’s rally is it or not. In the meantime, we remain focused on investing basics, including fundamental research and price awareness. We set multiple price targets for every stock we own (or consider owning) to reflect both good and bad scenarios to prevent us from blindly chasing (or hanging onto) positions. This enables us to stay true to our 10 Principles of Value Investing™, which demand paying low prices relative to earnings, cash flow, and intrinsic value to help create a margin of safety.

Wishing you and yours a Healthy and Happy New Year,

The Heartland Investment Team