The market’s mood ending 2023 was a mirror image of 2022, as hopes for a Goldilocks economic scenario, where inflation continues to moderate while the economy keeps growing, picked up steam. After losing ground in the summer months, the Russell 3000® Index surged more than 12% in the final three months of the year.

The Federal Reserve appeared to lend some credence to the “soft landing” narrative, especially after November data showed that the Consumer Price Index rose at only a slightly faster annual pace than in March 2021, during the COVID-19 shutdowns. With the Federal Open Market Committee signaling the likelihood of three interest rate cuts to come in 2024—and the futures market counting on six —investors flocked to parts of the market that stand to benefit early in an economic cycle, such as Financials, Consumer Discretionary, and Industrials. Meanwhile, those investors who started the year cautiously positioned were motivated to join the fray by bidding up early-cycle (and in many cases, highly leveraged) stocks late in the quarter.

It should be noted, however, that monetary policy tends to act with a lag. So, while the economy remains surprisingly resilient after nearly two years of interest rate hikes, the full effects of those higher rates may not have worked their way into the data yet.

For example, today’s 3.7% unemployment remains near historic lows, but small business new hiring plans have fallen to where they stood in February 2021, in the midst of the global pandemic, according to the National Federation of Independent Business. At the same time, four out of ten companies expect layoffs in 2024 and five out of ten are planning hiring freezes, according to a survey by the job search site ResumeBuilder.com.

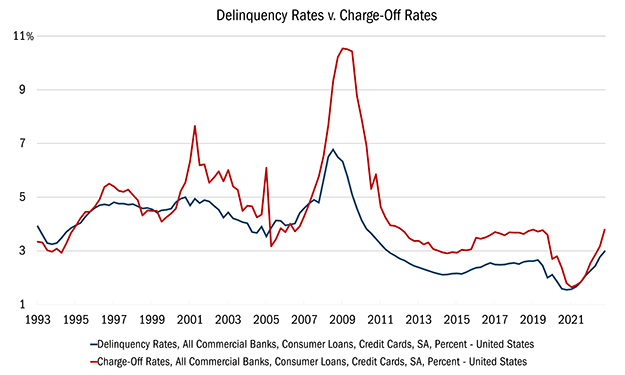

Mix in the fact that credit card delinquency and charge-off rates are now above their pre-pandemic levels—indicating that households have depleted their excess stimulus savings (see chart below)—and this paints a picture that isn’t as pretty as the consensus narrative would imply.

Source: FactSet Research Systems Inc., Quarterly data from 12/31/1993 to 09/29/2023. This chart represents Delinquency Rates compared to Charge-Off Rates in the United States. The delinquency rate is the amount of debt that is past due. Charge-off is a debt deemed uncollectible by the reporting firm. It is written off and removed from the firm's balance sheet. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

The fourth quarter was really a tale of two markets. From the end of September through October 27, the broad markets slumped, with large-caps losing slightly less than mid-caps, which sank a bit less than small. Since the Goldilocks scenario crystallized in late October, however, the Russell 2000® Index of small stocks is up 24.3% versus 20.5% for the Russell Midcap® Index and 16.2% for the S&P 500® Index of large stocks.

Small caps, in particular, have been performing better, especially after the deadline for mutual fund tax loss harvesting passed at the end of October. This could be an initial sign that what had been a historically narrow market, led by the so-called Magnificent 7 mega-cap stocks, is finally broadening. We continue to see opportunities down market cap. However, after the furious market rally since the end of October, the margin of safety has narrowed.

To be clear, our view of the economy is as valuable as any economic pundit, that is, it’s worthless. There was a lot to worry about entering 2023 including the war in Ukraine, high inflation, rising interest rates, etc., yet equities soared. 2023 should serve as a reminder that timing the market is a fool’s errand. We don’t know what the future holds for the economy or for stocks in the short run, but we do know the margin of safety in equities has narrowed significantly relative to one year ago and discipline is extraordinarily important. We believe that owning undervalued equities is a better way to compound wealth over the long term than holding cash or owning bonds.

Attribution Analysis

The Strategy gained 7.6% in the quarter, trailing the Russell 3000® Value Index, which posted returns of 9.8%. For the year, however, the Strategy outperformed the benchmark, gaining 13.1% in 2023 versus 11.7% for the Index, thanks almost entirely to stock selection.

The largest stocks in our portfolio (representing the top 10% by market capitalization) gained 4% during the quarter, while the smallest stocks returned 23%. As a result of that small-cap outperformance, the Strategy’s weighting shifted slightly from 31% small-cap/33% mid-cap/34% large-cap at the start of the quarter to 33% small/34% mid/30% large at the end.

Portfolio Activity

Our allocations to small-, mid-, and large-caps are not a top-down call. We let our bottoms-up stock selection organically dictate our weightings, and that focus on security selection is showcased in the following names:

Consumer Staples. A new position initiated in the quarter, Dollar General (DG), is an example of a business that offers visibility through an entire cycle.

Consumer Staples. A new position initiated in the quarter, Dollar General (DG), is an example of a business that offers visibility through an entire cycle.

DG operates more than 19,000 stores across the U.S., 80% of which are in towns with a population of less than 20,000. This rural focus results in core customers with incomes averaging around $35,000 a year. These customers rely on Dollar General to provide affordable products close to where they live. Roughly 75% of all goods sold by DG are daily necessities such as food, toiletries, and cleaning supplies, which limits demand cyclicality.

Yet operations haven’t been running smoothly over the past two years. DG grew rapidly over the years, including adding more than 900 new stores per year over the past 5 years. This growth was manageable until the pandemic struck and customer buying patterns changed while supply chain bottlenecks created major operational challenges. Strong consumer spending in 2020 and 2021, driven by stimulus funds, influenced management to order more discretionary inventory to support extended shipment lead times.

By 2023, however, excess stimulus savings were consumed, and spending patterns and supply chains began to normalize. DG found itself with too much discretionary inventory at warehouses, spotty in-store inventory, and a weakening consumer. Meanwhile, the purchasing power of DG’s core customer weakened due to inflationary pressures. As a result, same-store sales turned negative year over year in the second quarter. Operating margins also fell to an estimated 6.5% in fiscal year 2023, down from more than 10% in 2020, and the stock lost more than 57% of its value in the first nine months of the year.

But management is getting back to basics by improving in-store inventory availability, rationalizing discretionary inventory, and reducing consumable prices to help their core customer. To reduce supply-chain complexity, management is also reducing less-productive SKUs with the goal of improving margins and asset utilization. Discretionary inventory should be fully rationalized moving into 2024, and we expect DG’s same-store sales comparisons to improve with customer purchasing activity focused on essential products, where there is little downside.

The stock now trades at 17 times earnings expectations over the next 12 months, which is slightly above its median since-Initial Public Offering (IPO) multiple of 16.5x. We believe DG is underearning after the margin pressures experienced over the past two years. The company could earn more than $10 per share at an 8% EBIT margin, which would imply a multiple of less than 13 based on normalized earnings power.