Third Quarter Market Discussion

It’s an oft-heard refrain: To succeed in the long run, investors must ignore the short-term noise in the markets and focus on the things that really matter, like fundamentals and bottom-up security selection. This was a quarter where that advice hit home, as little seemed to transpire other than noise.

After climbing in July and slumping in August, stocks ended down in the three months ended Sept. 30. The S&P 500 Index finished the third quarter at -3.27% while the Russell Midcap® Index ended at -3.25%.

All this sound and fury signifying nothing arose, in part, from the mixed signals in economic data and the market itself. For instance, while employment and CPI/PPI releases kept feeding the “soft landing” narrative, several retailers issued earnings updates highlighting further pressures on both demand and operating costs. The pending expiration of student loan payment forgiveness poses another potential challenge to consumers already facing the effects of elevated interest rates and inflation.

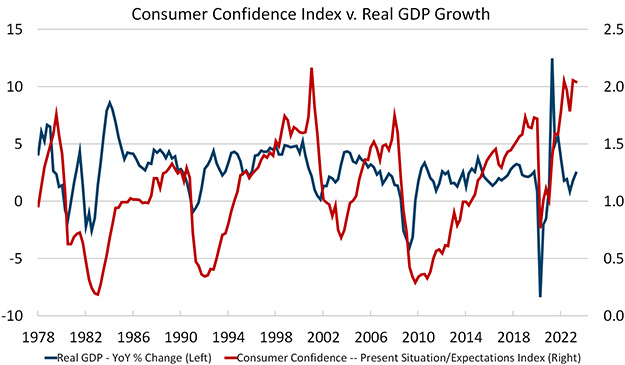

This is evidenced by consumer confidence in the current state of the economy remaining quite stable, as measured by the Conference Board. However, expectations for the coming six months have been sliding. History shows that current sentiment doesn’t tend to drop until just before or immediately after the start of a recession. With this in mind, we find the divergence between current conditions and future expectations noteworthy (see chart below).

Source: FactSet Research Systems Inc., Quarterly data from 3/31/1978 to 6/30/2023. This chart represents consumer confidence which is defined as present situation/expectations index compared to the real GDP – year over year percent change. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

The crosscurrents facing the consumer, along with stresses in the banking and commercial real estate industries, leave us questioning the validity of the soft-landing narrative. That said, we remain cautiously optimistic about our opportunity set. In this backdrop, we continue to focus on our strength: disregarding the macro noise and trying to control things that we can, such as identifying and analyzing promising, underappreciated stocks trading at attractive prices.

Attribution Analysis

The Mid Cap Value portfolio was down approximately 2.2% in the third quarter, outperforming the Russell Midcap® Value Index, which was down 4.46%. This was almost entirely attributable to stock selection, which was particularly strong in the Utilities and Industrials sectors and provided the largest contributions to relative performance. Our positions in the Energy (+23.28%) and Financials (+2.5%) sectors provided the largest gains for the quarter.

Portfolio Activity

Some value investors prefer owning high-quality companies (we consider this the “value” bucket of our investible universe) while others focus on deeply discounted companies that have produced poor economic returns over time but have statistically low valuations (we call this the “deep value” bucket of midcap investing).

Just as growth and value take turns outperforming, these two styles tend to alternate leadership within the value asset class. The representation of each bucket in the Russell Midcap® Value Index has shifted materially over time. Today, value and deep value have approximately equal weights in the benchmark. However, the value bucket represented as much as 65% in 2000 and as little as 25% in 2009. Given these dramatic shifts, ignoring either one of these buckets does not seem prudent, as it can introduce an unintended top-down bet into the portfolio.

We deliberately construct our portfolio with these two buckets in mind, without relying on top-down forecasts to favor one subset over the other. We build our portfolio through fundamental stock selection, relying on our 10 Principles of Value Investing™ within a two-bucket approach.

With that background in mind, the following three holdings are worth highlighting:

Financials. First American Financial (FAF), the second-largest title insurance provider in the U.S., is a quintessential value bucket example (buying a high-quality operator at an attractive valuation when their business is in a recession).

Financials. First American Financial (FAF), the second-largest title insurance provider in the U.S., is a quintessential value bucket example (buying a high-quality operator at an attractive valuation when their business is in a recession).

While most people don’t think about title insurance when purchasing a home, policies indemnify homeowners and lenders against title defects that could result in significant losses arising from back taxes, liens, and other claims. Rising mortgage rates over the past two years have weighed on First American shares, as 30-year fixed rate residential mortgages more than doubled from around 3% at the end of 2021 to more than 7% today. Residential refinance volumes plunged 85% by late 2022, while new purchase volumes fell more than 40%. As a result, FAF’s earnings expectations are down nearly 50% relative to the cycle peak.

However, the year-over-year decline in the Mortgage Bankers Association Purchase Index is getting “less bad,” which is often when the share prices of good companies begin to recover (as long as the market considers the improvement to be sustainable). Meanwhile, management has taken several self-help steps to improve profitability. Examples include exiting unprofitable property and casualty operations and automating manual processes, which should boost margins.

FAF shares trade at just 12X earnings, based on forecasts for the next 12 months. While a P/E ratio of 12X is in line with the insurance industry, we do not believe the broader industry has the same cyclical earnings upside as First American. Historically, title insurers have traded at 15X or higher early in a cyclical recovery.

Energy. NOV Inc. (NOV), our largest holding, is a deep value company benefiting from a self-help business strategy. NOV is a leading oilfield services company that provides technical expertise, advanced equipment, and operational support for the oil and gas industry.

Energy. NOV Inc. (NOV), our largest holding, is a deep value company benefiting from a self-help business strategy. NOV is a leading oilfield services company that provides technical expertise, advanced equipment, and operational support for the oil and gas industry.

The company survived a prolonged bear market for oil prices that lasted from 2014 through COVID-19 related demand destruction in 2020. During this time, the industry went into capital starvation mode. NOV used the industry downturn to streamline its cost structure and retire debt in order to maintain an industry-leading balance sheet. The company has eliminated $850 million in structural fixed costs since the start of 2019.

Despite heavy cost-cutting, NOV never stopped developing new value-added product applications, which strengthened its position as weaker competitors went away and the industry outlook subsequently improved. This should allow NOV to generate strong returns on capital as the energy upcycle unfolds, with offshore wind and other renewables providing capital-efficient ancillary growth for the company.

Consumer Staples. During the quarter, we initiated a new position in Spectrum Brands Holdings (SPB), another deep value company with multiple self-help catalysts.

Consumer Staples. During the quarter, we initiated a new position in Spectrum Brands Holdings (SPB), another deep value company with multiple self-help catalysts.

After several divestitures in recent years, Spectrum is mostly a pureplay Consumer Staples company focusing on pet care and home and garden supplies, including recognizable brands such as Spectracide lawn and garden products and SmartBone dog treats.

SPB is in the process of transforming itself from an acquisition-oriented holding company into an integrated operating company with sharper focus. As part of that process, the company recently divested its Hardware and Home Improvement segment, selling it to the Swedish conglomerate Assa Abloy for $4.3 billion in cash. We owned Spectrum when this divestiture was originally announced but exited our position when the Department of Justice (DOJ) sued to block the sale. That action threatened to derail SPB’s efforts to improve its balance sheet and shed a highly discretionary segment that was noncore to the company’s strategy.

We recently got clarity on this overhang, when the DOJ reached a settlement with Assa Abloy, allowing the sale to go through. This gives SPB ample capacity to repurchase shares at a steep discount to intrinsic value while setting the stage for operational improvements. Meanwhile, the stock trades at just 7X next year’s EBITDA and 5X to 5.5X normalized EBITDA.

Outlook

The third quarter showed investors that even if one thinks that they know the general direction the economy is headed, market cycles never unfold in a straight line. We have some continued concerns about parts of the economy, such as the banking and commercial real estate industries. That said, we understand the risks of constructing a portfolio around a macro narrative that may not unfold exactly as envisioned.

That’s why in times like this, we focus on what we can control: bottom-up security selection guided by our 10 Principles of Value Investing™, which focuses on financial soundness, skilled management, compelling business strategies, positive earnings dynamics, attractive valuations, and strong catalysts for recognition.