I’m no skier, and I’m not fond of heights, but I’ve watched enough downhill ski races to understand one thing: momentum is essential, and it’s also dangerous. Speed is how races are won. Skiers tuck in, reduce friction, and take aggressive lines through turns to gain every advantage. But the faster they go, the smaller their margin for error becomes.

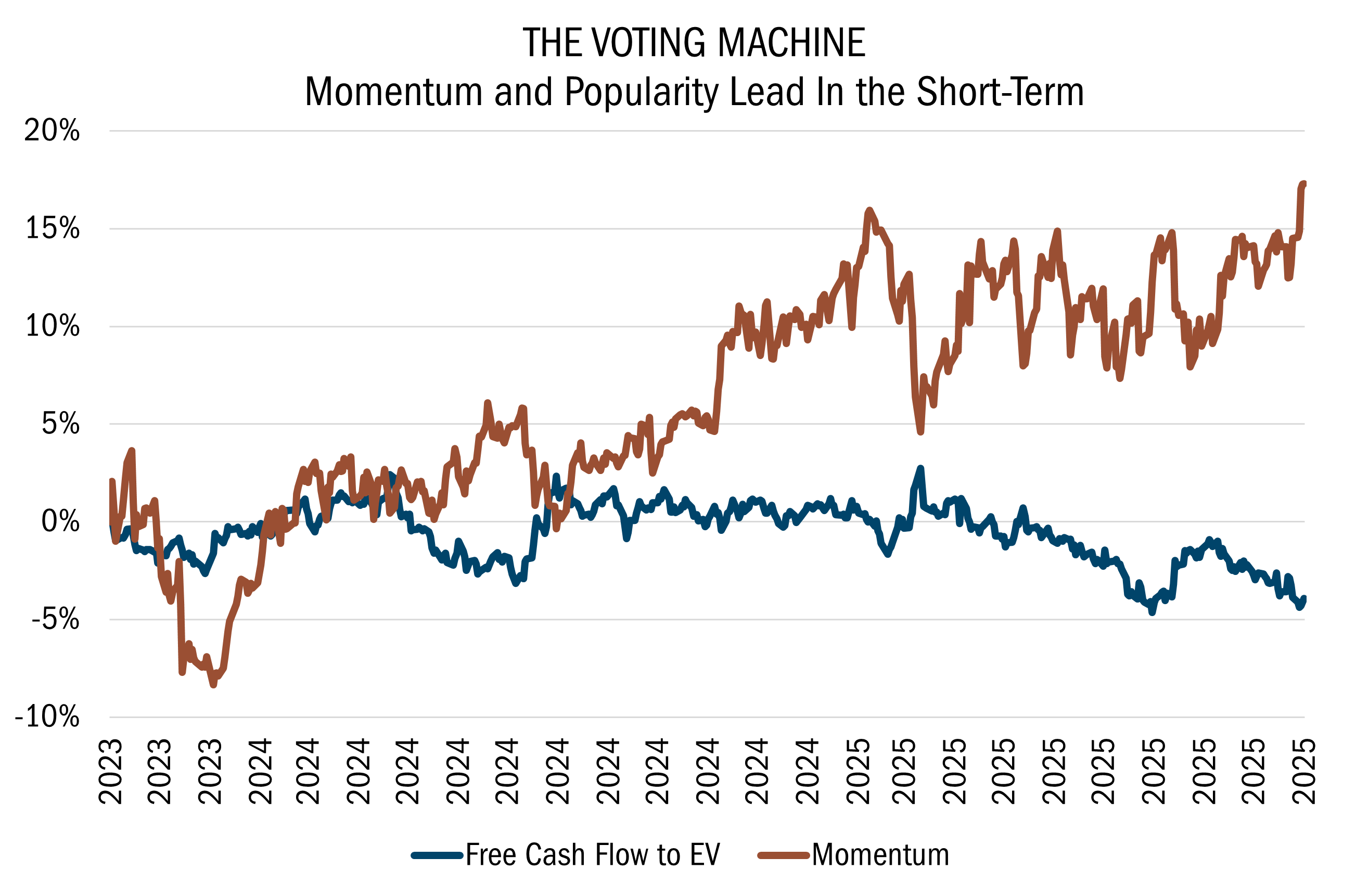

Markets behave much the same way. Stocks that perform well often continue to outperform in the short term, reinforcing the old Wall Street saying, “Don’t fight the tape.” Popularity and price momentum can carry markets, and individual stocks, much farther and faster than fundamentals alone would suggest.

Benjamin Graham famously described this dynamic by saying that in the short run, the market is a voting machine, but in the long run, it is a weighing machine. In the voting phase, popularity matters. Investors “vote” with their dollars, rewarding what’s in favor and reinforcing momentum. This is how themes like AI and the so-called Magnificent Seven can dominate market leadership for extended periods.

Source: Piper Sandler & Co. Daily data 1/2/2024 to 10/31/2025. The data in this chart represents the S&P 500 Factor data of long/short portfolios of stocks with high/low Free Cash Flow to Enterprise Value and Momentum. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

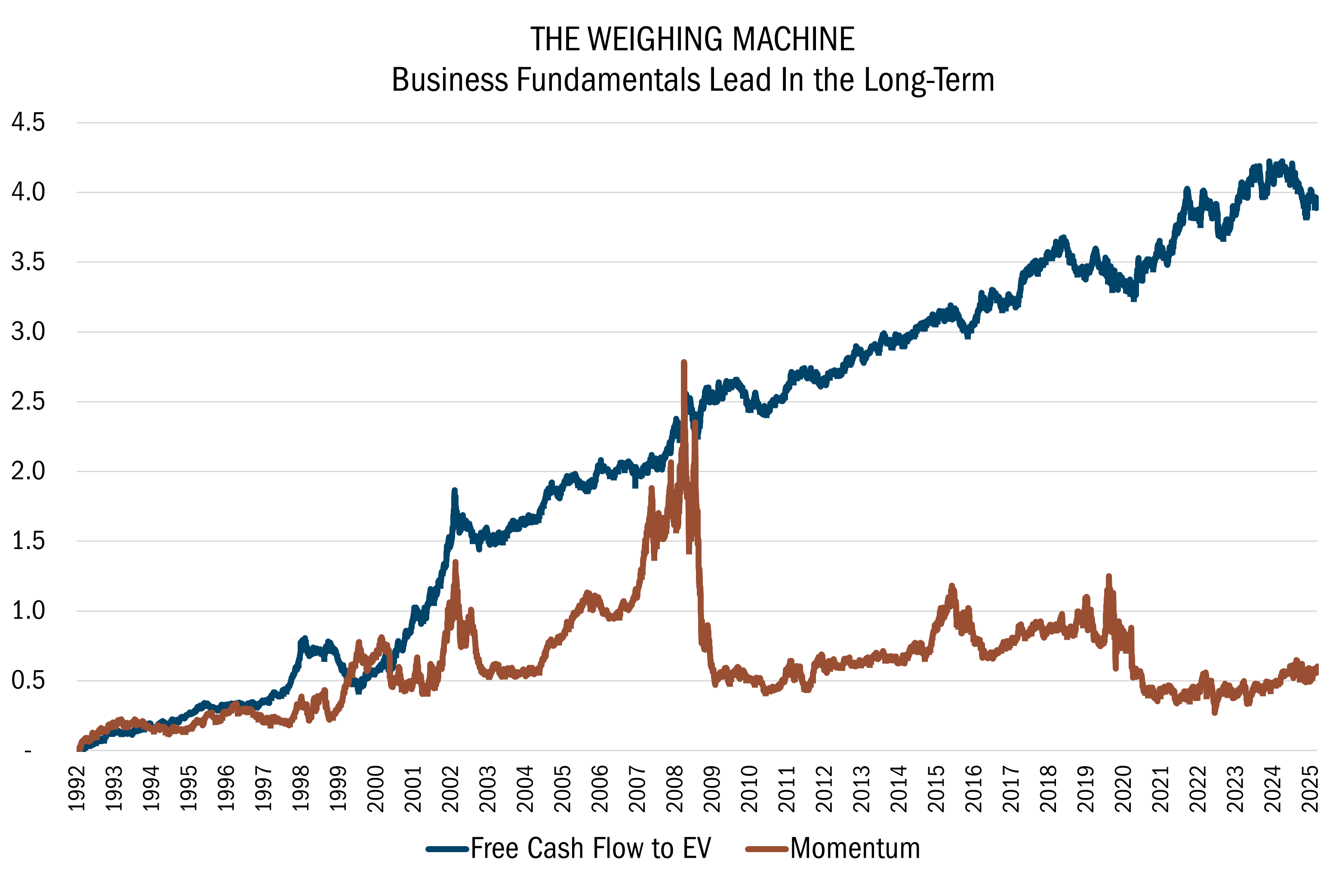

But eventually, the market begins to weigh. And when it does, fundamentals determine outcomes. Metrics that reflect true economic substance start to matter more than headlines or narratives. One such measure of weight is free cash flow relative to enterprise value. Over time, companies that consistently generate strong free cash flow compared to what investors are paying for the entire business tend to deliver more durable returns.

Source: Piper Sandler & Co. Daily data 12/2/1985 to 10/31/2025. The data in this chart represents the S&P 500 Factor data of long/short portfolios of stocks with high/low Free Cash Flow to Enterprise Value and Momentum. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

The ski analogy still applies. Momentum feels comfortable when conditions are smooth. But as speed builds, the course narrows, a patch of ice, a blind turn, or a sudden shift in terrain can demand immediate control. In the markets, elevated valuations create similar risks. When investors pay increasingly higher prices for each dollar of cash flow, even small disappointments can force abrupt corrections.

The solution, however, isn’t to slam on the brakes. A skilled skier doesn’t stop mid-run or make wild, abrupt turns. Instead, they make subtle adjustments-edging slightly, widening a turn, or easing their line, to manage risk while staying in motion.

Investors can take the same approach. Rather than making all-in or massive portfolio shifts, risk can be managed through modest, deliberate changes: trimming exposure where popularity has driven valuations too far, rebalancing toward companies with stronger free cash flow relative to enterprise value or gradually improving diversification. These incremental steps can meaningfully improve stability without abandoning opportunity.

At Heartland, this philosophy is embedded in our 10 Principles of Value Investing™. We focus on well-managed, financially sound companies with durable business models, strong free cash flow generation, and attractive valuations. These companies may not always be winning the popularity contest, but they tend to carry more weight over the long term.

When sentiment eventually shifts, as it has historically done, the market’s weighing machine generally takes over. Our 40+ years of experience has taught us that when fundamentals matter most, momentum loses its edge, and disciplined, value-oriented investing is better positioned to reach the finish line.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters' views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Statements regarding securities are not recommendations to buy or sell.

The above individuals are registered representatives of ALPS Distributors, Inc.

Heartland’s investing glossary provides definitions for several terms used on this page.