Seeks long-term appreciation by investing in mid-cap, dividend paying companies

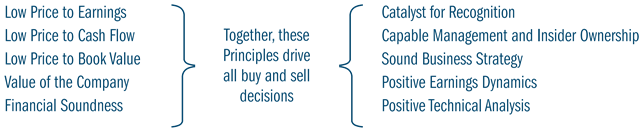

The Heartland Mid Cap Value Strategy is designed to provide mid cap value exposure by investing in two distinct baskets of stocks (40-60 holdings), value and deep value. This approach helps potentially mitigate the risk of underperformance resulting from the inherent cyclicality of each basket and may increase the likelihood of potential consistent outperformance relative to the Russell Midcap® Value Index. A collection of rules and tools are used to construct the overall portfolio such that stock selection is the primary driver of relative performance. The narrow focus on specific catalysts that may unlock value adds discipline and consistency.

Mid-sized companies are defined as companies with a market cap range consistent with the Russell Midcap® Value Index.

Minimum: $500,000

| Account Size | Annual Rate (%) |

|---|---|

| First $5 million | 1.00 |

| Next $10 million | 0.85 |

| Above $15 million | Negotiable |

12/31/2025

Scroll over to view complete data

| Since Inception (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD (%) | QTD (%) | |

|---|---|---|---|---|---|---|---|

| Mid Cap Value Composite (Net of Advisory Fees) | 10.80 | 9.97 | 8.25 | 5.93 | 0.46 | 0.46 | -1.85 |

| Russell Midcap® Value | 10.21 | 9.78 | 9.83 | 12.27 | 11.05 | 11.05 | 1.42 |

|

|

2025 (%) |

2024 (%) |

2023 (%) |

2022 (%) |

2021 (%) |

2020 (%) |

2019 (%) |

2018 (%) |

2017 (%) |

2016 (%) |

2015 (%) |

2014 (%) |

2013 (%) |

2012 (%) |

2011 (%) |

2010 (%) |

2009 (%) |

2008 (%) |

2007 (%) |

2006 (%) |

2005 (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mid Cap Value Composite (Net of Advisory Fees) |

0.46 | 3.98 | 13.83 | -2.64 | 28.41 | 8.72 | 25.43 | -8.26 | 8.55 | 28.25 |

-6.64 |

10.78 |

39.46 |

10.49 |

-7.72 |

25.29 |

35.14 |

-22.19 |

5.13 |

24.10 |

18.41 |

|

Russell Midcap® Value |

11.05 | 13.07 | 12.71 | -12.03 | 28.34 | 4.96 | 27.06 | -12.29 | 13.34 | 20.00 |

-4.78 |

14.75 |

33.46 |

18.51 |

-1.38 |

24.75 |

34.21 |

-38.44 |

-1.42 |

20.22 |

12.65 |

*Source: FactSet Research Systems Inc., Russell Investment Group, and Heartland Advisors, Inc.

YTD and QTD returns are not annualized. The Strategy's inception date is 9/30/1996.

Scroll over to view complete data

| Weighted Average Market Cap ($) | Median Market Cap ($) | Trailing 1-Year Turnover (%) | |

|---|---|---|---|

| Mid Cap Value Composite | 29.4 billion | 19.7 billion | 71.5 |

| Russell Midcap® Value | 27.6 billion | 11.8 billion | - |

Source: FactSet Research Systems Inc., Russell Investment Group, and Heartland Advisors, Inc.

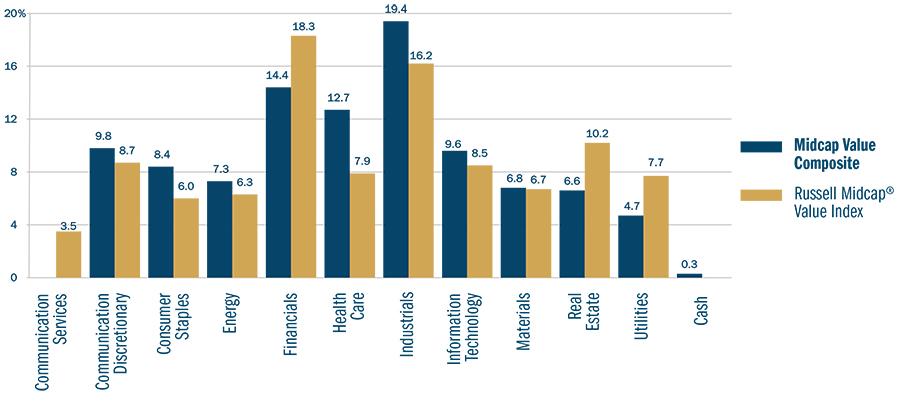

Source: FactSet Research Systems Inc., and Russell Investment Group

Composite statistics shown as percentage of equity investmentsty investments

Scroll over to view complete data

| Ticker | Holding | % of Account | Industry |

|---|---|---|---|

| TDY | Teledyne Technologies, Inc. | 4.3 | Electronic Equipment Instruments & Components |

| PSA | Public Storage | 3.4 | Specialized REITs |

| JBHT | JB Hunt Transport Services, Inc. | 3.1 | Ground Transportation |

| EXC | Exelon Corp. | 3.0 | Electric Utilities |

| HSY | The Hershey Company | 3.0 | Food Products |

| EOG | EOG Resources Inc | 3.0 | Oil Gas & Consumable Fuels |

| BDX | Becton, Dickinson & Company | 3.0 | Health Care Equipment & Supplies |

| DCI | Donaldson Company, Inc. | 2.8 | Machinery |

| NTRS | Northern Trust Corp. | 2.8 | Capital Markets |

| FE | FirstEnergy Corp. | 2.6 | Electric Utilities |

| % of Total Net Assets | 31.0 | ||

Scroll over to view complete data

| Alpha* | Standard Deviation (%)* | Beta | Info Ratio | Sharpe Ratio | Upside Capture (%)* | Downside Capture (%)* | R- Squared (%) | Active Share | |

|---|---|---|---|---|---|---|---|---|---|

| Mid Cap Value Composite (Net of Advisory Fees) | -0.27 | 15.40 | 0.87 | -0.30 | 0.32 | 83.37 | 86.83 | 90.54 | 93.41 |

| Russell Midcap® Value | 0.00 | 16.91 | 1.00 | 0.00 | 0.39 | 100.00 | 100.00 | 100.00 | 0.00 |

*Annualized

Source: FactSet Research Systems Inc., Russell Investment Group

Alpha, beta, and information ratio are versus the Russell MidCap® Value Index.

Certain performance, portfolio composition, and/or risk analysis data may be preliminary.

65 years of industry experience

48 years of experience at Heartland

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results. Performance represents past performance, and current returns may differ.

Heartland Advisors, Inc. (the "Firm") claims compliance with the Global Investment Performance Standards (GIPS®). The Firm is a wholly owned subsidiary of Heartland Holdings, Inc., and is registered with the Securities and Exchange Commission. For a complete list and description of Heartland Advisors composites and/or a presentation that adheres to the GIPS® standards, contact the Institutional Sales Team at Heartland Advisors, Inc. at the address listed below.

The U.S. dollar is the currency used to express performance.

The inception date for the Mid-Cap Value Strategy is 9/30/1996.

The Mid Cap Value Strategy invests in mid–sized companies on a value basis. Mid-sized securities generally are more volatile and less liquid than those of larger companies.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

Representative account chosen based on composite membership, not on performance-based criteria. Other accounts within the strategy may have different holdings.

Representative account holdings are preliminary, may not be reconciled, and may be updated when reconciled.

Certain security valuations and forward estimates are based on Heartland Advisors' calculations. Certain outliers may be excluded. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Heartland’s investing glossary provides definitions for several terms used on this page.

CFA® is a registered trademark owned by the CFA Institute.

Separately managed accounts and related investment advisory services are provided by Heartland Advisors, Inc., a federally registered investment advisor. ALPS Distributors, Inc., is not affiliated with Heartland Advisors, Inc.