At Heartland, one of our 10 Principles of Value Investing™ focuses on identifying stocks with a “catalyst for recognition” that may cause the share price to rise in the near term. Although it is hard to find a catalyst as big as a potential housing market recovery, as investments in spending on residential property investments and housing services account for as much as 18% of U.S. GDP.

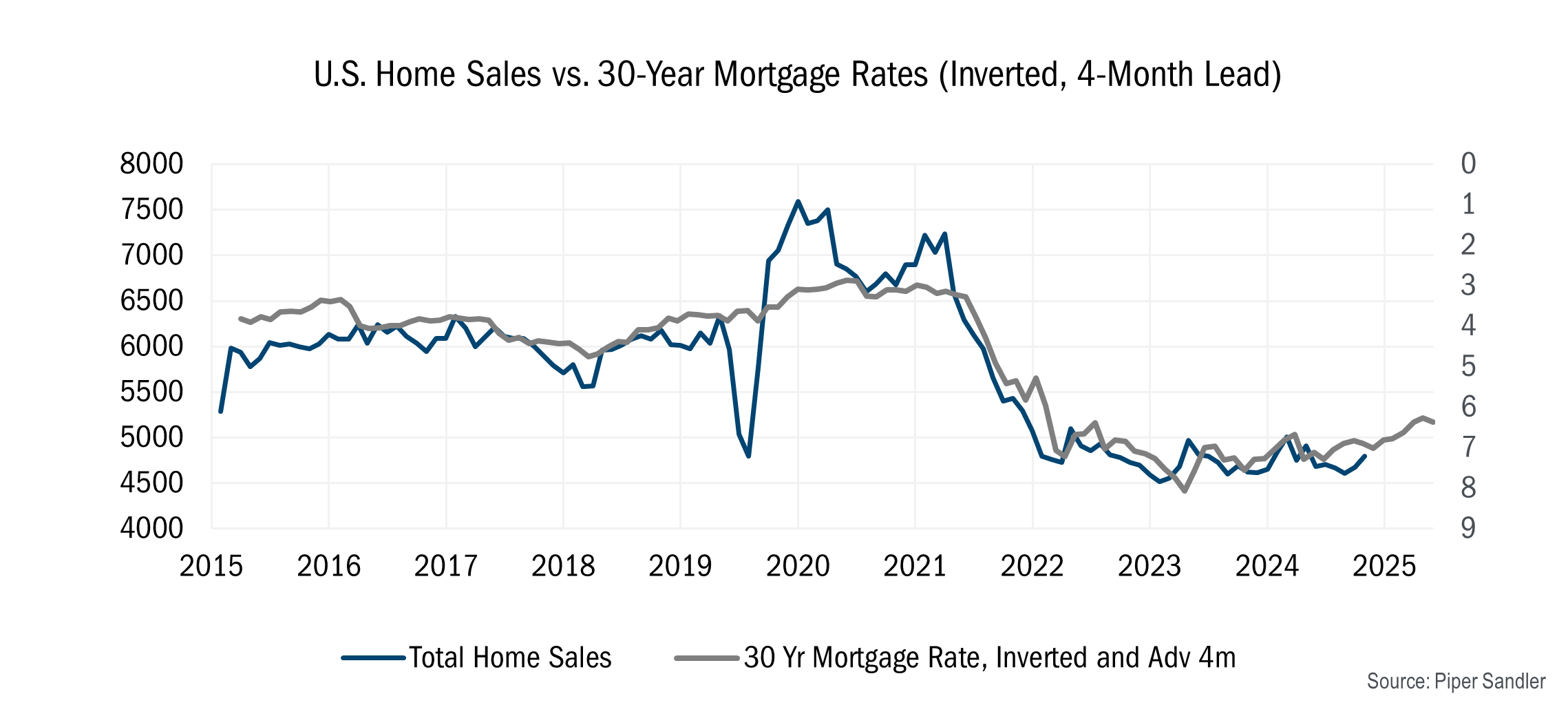

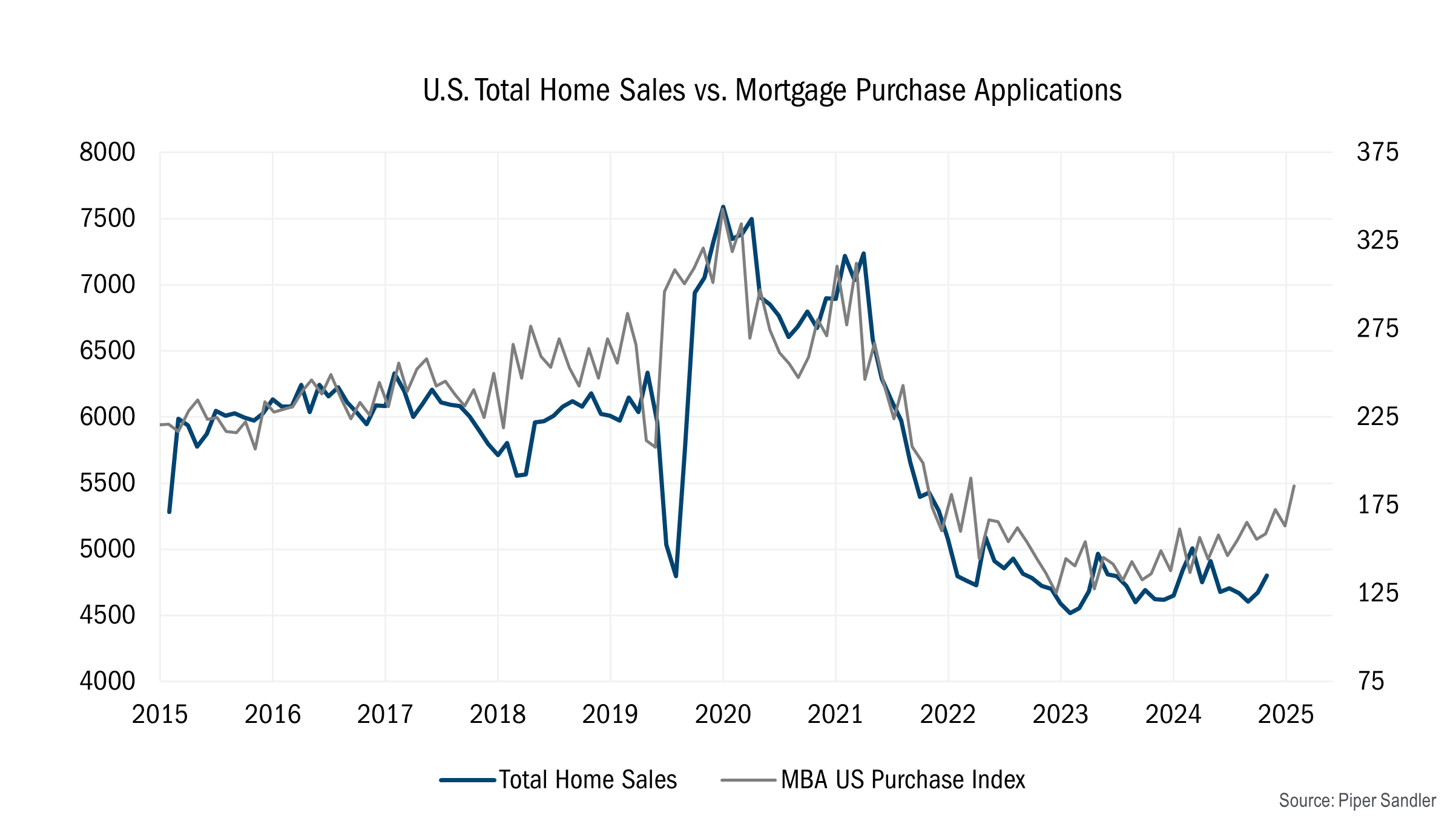

In recent years, elevated mortgage rates, a weakening employment outlook, and housing affordability issues have put a damper on housing turnover. This has had knock-on effects on home furnishing retailers and other businesses whose revenues are tied to home construction and sales. But if history is any guide, recent struggles in the labor market that led the Federal Reserve to lower rates in the first place could spark a rebound in the sector (see the charts below).

Source: Bloomberg via Piper Sadle. Monthly data 11/30/2015 to 12/3/2025 This chart shows the inverse relationship between U.S. mortgage rates and total home sales. The 30-year mortgage rate is inverted and advanced by approximately four months to highlight its historical tendency to lead changes in home sales. U.S. Total Home Sales are represented by the sum of US New One Family Houses Sold Annual Total (SAAR) and US NAR Total Existing Home Sales (SAAR). Mortgage demand is represented by the MBA US Purchase Index (SA). Mortgage rates reflect the Bankrate.com U.S. Home Mortgage 30-Year Fixed National Average. It is not possible to invest in an index. Past performance does not guarantee future results.

Source: Bloomberg via Piper Sadle. Monthly data 11/30/2015 to 12/3/2025 The data in this chart represents mortgage purchase applications and U.S. home sales move closely together, with changes in the MBA Purchase Index often leading shifts in total home sales, highlighting mortgage demand as an early indicator of housing market activity. U.S. Total Home Sales are represented by the sum of U.S. New One Family Houses Sold Annual Total (SAAR) and U.S. NAR Total Existing Home Sales (SAAR). Mortgage demand is represented by the MBA US Purchase Index (SA). Mortgage rates reflect the Bankrate.com U.S. Home Mortgage 30-Year Fixed National Average. It is not possible to invest in an index. Past performance does not guarantee future results.

Yet as value investors, top-down macro tailwinds don’t drive our security selection decisions. Most of our 10 Principles of Value Investing™ are fundamental factors that require us to examine companies from the bottom up. And one thing we look for are companies with capable management teams that are deploying strategies to expand their sales and margins regardless of economic circumstances. These are businesses poised to improve even if macro catalysts don’t materialize. If they do, however, these companies have put in place self-improvements that should maximize the benefits they may enjoy from an improving economy.

An example is RH, the luxury home furnishing retailer that has been undertaking self-help strategies by growing market share amid a sluggish housing market. The retailer recently generated same-store sales growth of more than 5%, outperforming the broader furniture market over the past 2 years. And after investing for growth in new markets, the company’s capex spending should be more modest going forward, giving management an opportunity to lever their operating margins, which would be amplified if housing turnover improves.

We try to look at securities from a variety of perspectives, from the bottom up and top down while considering both headwinds and tailwinds that are company specific, industry specific, and macro in nature. Only then can we determine the true risk/reward potential of the securities we are examining. All being said, we continue to use our 10 Principles of Value Investing™ to help lead us to all our portfolio decisions.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

As of 12/19/2025 the Heartland Advisors, Inc., on behalf of its clients, held approximately 0.12% of total shares outstanding of Restoration Hardware (RH).

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters' views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

Heartland’s investing glossary provides definitions for several terms used on this page.

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

ALPS Distributors, Inc., is not affiliated with Heartland Advisors.