Gates Industrial Corporation (GTES)

This company is a leading manufacturer of belts and hoses used in vehicles and industrial machines. Heartland holds GTES in multiple Strategies.

Meeting at Headquarters

During his visit, Jacob met with the Investor Relations Team and toured the Gates Customer Experience Center, where he engaged in an in-depth discussion about the business and its products.

He observed Gates-manufactured components in action, gaining insight into their diverse applications. A key initiative—replacing traditional chains with lightweight rubber belts—was demonstrated through a hands-on comparison. Jacob noted the significant weight difference, highlighting the efficiency and innovation of Gates’ solutions.

He observed Gates-manufactured components in action, gaining insight into their diverse applications. A key initiative—replacing traditional chains with lightweight rubber belts—was demonstrated through a hands-on comparison. Jacob noted the significant weight difference, highlighting the efficiency and innovation of Gates’ solutions.

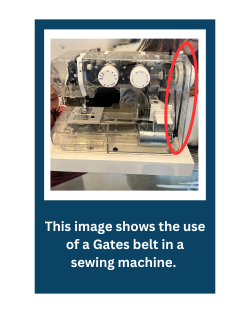

He also developed a deeper appreciation for the engineering behind seemingly simple products. Everyday items, such as sewing machines (see image), rely on Gates' belts for functionality.

Overall, Jacob found the research trip highly valuable, recognizing Gates’ products as effective and versatile solutions for modern machinery.

versatile solutions for modern machinery.

Evaluating GTES Through the 10 Principles of Value Investing™

Using our proprietary framework of 10 qualitative and quantitative measures, GTES demonstrated several attractive characteristics:

Using our proprietary framework of 10 qualitative and quantitative measures, GTES demonstrated several attractive characteristics:

Key Questions for Management

1. How are tariffs affecting your business, and how do you compare to competitors?

2. Can you elaborate on opportunities in data centers and HVAC?

3. What is Gates’ competitive edge in maintaining leadership?

Main Takeaways

Thanks for following Jacob’s journey! Stay tuned for more exclusive insights ahead!

Want to Join Along for More Research Trips?

Check Out Our Where's Will series, to see our 10 Principles of Value Investing™ in Action HERE!

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

An investor should consider the Funds' investment objectives, risks, and charges and expenses carefully before investing. This and other important information may be found in the prospectus. To obtain a print prospectus, call 800-432-7856. or visit heartlandadvisors.com. Please read the prospectus carefully before investing.

There is no guarantee that a particular investment strategy will be successful.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters' views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

As of 6/30/2025, Heartland Advisors on behalf of its clients held approximately 0.31% of shares outstanding of Gates Industrial Corporation plc (GTES), Statements regarding securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future holdings are subject to risk.

Economic predictions are based on estimates and are subject to change.

Heartland Advisors’ 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.

Heartland’s investing glossary provides definitions for several terms used on this page.

ALPS Distributors, Inc., is not affiliated with Heartland Advisors.