When referring to value investing, it is often described as “buying what is cheap.” In practice, that definition is incomplete. Cheap is easy to find, but finding true value in a universe littered with hundreds of cyclical stocks or undervalued companies require a strategy that utilizes both the art and science to uncover intrinsic value.

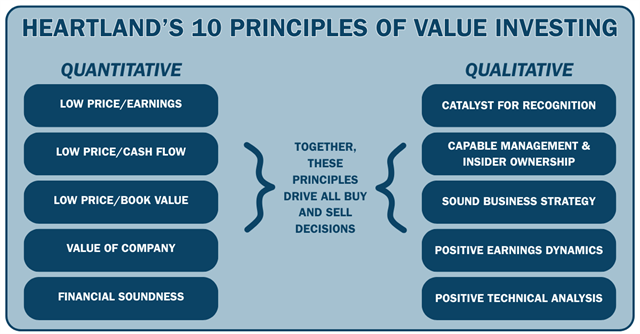

Our investment process at Heartland is built around 10 valuation metrics that strategically combine quantitative discipline with qualitative judgment. Together, these factors form the framework by which every buy and sell decision is made. The quantitative principles allow us to determine if we are getting a financially secure business at a discounted price, and the qualitative principles help us determine if we are finding a good business with value creating strategies. It is the interaction between the two, working together, which defines our edge.

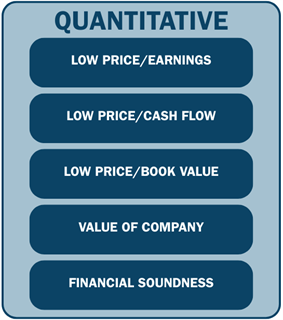

The quantitative principles are the foundation of our process. They are intended to be fixed, repeatable, and unemotional. A company either meets them, or it does not.

These principles answer two critical questions, when looking at a stock, these include: Is the stock objectively undervalued? Is the business financially sound?

We determine this by looking for Low Price to Cash Flow, Low Price to Earnings, Low Price to Book Value, the Value of the Company, and Financial Soundness, all the key evaluation metrics that make up the quantitative side of our 10 Principles of Value Investing™. By measuring valuation and financial strength together, we establish a margin of safety.

It is important to note that the quantitative measures do not make up the buy or sell decision itself. Many of the businesses we evaluate consistently score well on quantitative metrics, but that does not make them good investments, necessarily. While this might be where other value investors stop, at Heartland, we use this to determine if we continue to evaluate from a qualitative perspective.

The qualitative Principles take a numerically undervalued stock, which was determined in the quantitative analysis, and gets to know the REAL business. This can include factors such as how value will be created and what the range of opportunities looks like throughout a variety of scenarios. We consider this to be the art of our 10 Principles of Value Investing™.

The art is interpreting the science and comparing it to others in a company’s industry or in the broader opportunity set. This separates these undervalued businesses from ones that are cheap due to being structurally cyclical, low quality, or poorly managed. Others are mispriced because the market has not yet recognized change. Our qualitative work is how we separate the two. The market is very good at pricing what already exists, but far less effective at pricing what is about to change. This determines our alpha generation, namely identifying the Catalyst for Recognition, understanding the Capabilities of the Management Team and if there is a Sound Business Strategy that will change the market’s perception of company.

The art of value investing is not about one singular aspect of these qualitative factors, but how each of them work together to paint the greater picture and tell the story of the business. We evaluate how we believe a business evolves from undervalued to valuable, which are often businesses that score well on the quantitative principles, and exhibit multiple positive qualitative forces acting at once. This could be multiple catalysts, such as, good management capabilities, strong capital allocation, advantaged business model or positioning within industry. A stock that is merely cheap without these attributes can be found to have a high likelihood of being a value trap or a short-lived cyclical trade. We believe this alignment mitigates risk and increases the probability of success.

The same Principles that guide our buys also guide our sells. Quantitatively, we monitor how valuation and financial strength evolve. Qualitatively, we reassess whether catalysts are playing out, whether management is executing, and whether the business still deserves the valuation it is approaching. A stock may become expensive without the business improving, or a stock may rise while the qualitative thesis deteriorates. We aim to create a balanced process. The art does not override the science, and the science does not ignore the art.

Our 10 Principles of Value Investing ™ are not a checklist, but rather a process. The quantitative principles establish that we are looking at a value stock with financial stability. The qualitative principles determine whether that value can compound, value is unlocked, and ultimately recognized by the market . The science keeps us honest and the art keeps us differentiated.

Value investing is not choosing between art or science, but striving to master both, and knowing when each one matters most, which is why we continue to use our time tested 10 Principles of Value Investing™ which have led all our portfolio decisions at Heartland for over 40 years.

©2026 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters' views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Heartland Advisors’ 10 Principles of Value Investing™ consist of the following criteria for selecting securities: (1) catalyst for recognition; (2) low price in relation to earnings; (3) low price in relation to cash flow; (4) low price in relation to book value; (5) financial soundness; (6) positive earnings dynamics; (7) sound business strategy; (8) capable management and insider ownership; (9) value of company; and (10) positive technical analysis.

Small-cap investment strategies, which emphasize the significant growth potential of small companies, have their own unique risks and potential for rewards and may not be suitable for all investors. Small-cap securities are generally more volatile and less liquid than those of larger companies.

Heartland’s investing glossary provides definitions for several terms used on this page.