Warren Buffett famously stated that he makes “no attempt to forecast the general market — my efforts are devoted to finding undervalued securities.” That’s how we’ve always gone about our business, and it certainly represents how we approached the recently ended quarter.

Throughout the third quarter, there was great debate surrounding the health of the economy. While most investors now believe that a “soft landing” is the base-case scenario, there are plenty who are worried about the economic headwinds blowing in, including tighter lending standards, strains in the commercial real estate market, and new-found concerns over the strength of the consumer. Among them: the sharp decline in the personal savings rate, the uptick in consumer loan delinquencies, persistent inflation punctuated by rising gas prices, and slumping confidence in the expected future state of the economy.

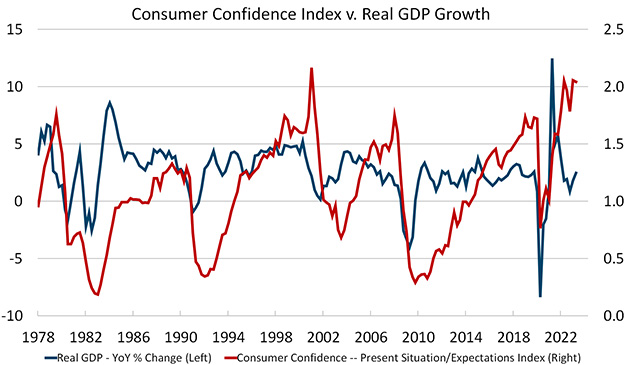

Although consumers appear assured about the current environment, history shows that a wide gap between their view of today’s economic situation versus their future prospects, as represented by the Conference Board’s Present Situation Index (see below), often signals weaker economic growth ahead. While a much-anticipated recession has taken longer to transpire than many thought, the full effect of Federal Reserve monetary policy tightening has yet to be reflected in economic activity.

Source: FactSet Research Systems Inc., Quarterly data from 3/31/1978 to 6/30/2023. This chart represents consumer confidence which is defined as present situation/expectations index compared to the real GDP – year over year percent change. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Whether a soft landing is in the cards or not, our goal remains the same: be patient and disciplined investors while identifying opportunities through our 10 Principles of Value Investing™. We want to remain nimble and use this period of uncertainty to find well-managed, financially strong, and attractively priced businesses that can grow cash flow and value over time.

Attribution Analysis

For the quarter, the Strategy outperformed the Russell 3000® Value Index, posting gains of 0.05% versus -3.15% for the benchmark. In a somewhat volatile market where stocks rallied in July and sold off as long-term interest rates rose materially, positive gains were achieved in six of the eleven sectors, led by Energy (+16.82%), Utilities (+11.23%), and Materials (+9.19%).

Stock selection was the key driver of outperformance, with particularly strong showings in Industrials, Materials and Utilities. The only area where selection detracted from the Strategy’s performance was Information Technology.

Last quarter, we discussed how narrow the market’s breadth had been all year, as just a handful of the largest stocks accounted for the lion’s share of the market’s returns. Earlier in 2023, this put our all-cap Strategy at a disadvantage, as the S&P 500 Index more than doubled the returns of the Russell 2000 Small-Cap® Index between January 1 and June 30.

While market breadth has yet to broaden meaningfully, the playing field did begin to even out this quarter. Within the Russell 3000 Value® Index, small caps outpaced large stocks by around 500 basis points in July but gave more than that back over the past eight weeks. For the quarter, there was little disparity by market cap in the all-cap benchmark, removing a hindrance — at least for the moment. We wouldn’t be surprised if headwinds intensified before market breadth improves on a sustainable basis, which typically occurs early in a capital market cycle following the onset of an economic recession.

Portfolio Activity

It should be noted that our overweight to small- and mid-caps, relative to our benchmark, is not a top-down call. We let our bottom-up stock selection organically dictate our weightings, and that focus on security selection is showcased in the following businesses:

Industrials. Canadian National Railway (CNI) is one of five Class I freight railroads in the U.S. and Canada, which operate with high margins because of an attractive industry structure. A typical freight customer has only one or two choices when shipping products via rail, and alternative modes of transportation are significantly more expensive. As a result, railroads are blessed with robust pricing power. CNI shares slumped in the third quarter, as the freight market entered a recession and as Canadian wildfires disrupted network efficiency.

Industrials. Canadian National Railway (CNI) is one of five Class I freight railroads in the U.S. and Canada, which operate with high margins because of an attractive industry structure. A typical freight customer has only one or two choices when shipping products via rail, and alternative modes of transportation are significantly more expensive. As a result, railroads are blessed with robust pricing power. CNI shares slumped in the third quarter, as the freight market entered a recession and as Canadian wildfires disrupted network efficiency.

While these challenges should be temporary, we believe self-help strategies that management has instituted will bolster results for years to come. They include expansion projects in Halifax and Prince Rupert and a strategic shift from a focus on margin maximization to on-time train departures that’s aimed at improving rail service. These initiatives should drive market-share gains from the more costly truck market and result in higher earnings power over a cycle.

We first purchased CNI in 2020, after the COVID-19 induced market selloff. As the stock rebounded in the aftermath of the pandemic and approached our estimate of intrinsic value, we reduced our position. With shares now trading at a meaningful discount to value, we added to the position.

Trading at 18X next 12 months’ forecasted earnings, the stock doesn’t look extremely cheap on paper. However, CNI normally trades at a 10% to 20% premium to the S&P 500 and at 25-30x cycle trough earnings. In our opinion, this is a better business than most, yet we are paying an average price after estimates have been cut.