After rallying at the end of last year, the equity market continued to climb in the first quarter, as many investors stopped worrying about potential economic weakness and shifted their focus to how a pivot in Federal Reserve monetary policy could be a meaningful tailwind to asset values. The Russell 3000® Index gained 10.02% in the first three months of the year and is up 29.29% over the past year.

While euphoria surrounding artificial intelligence (AI) proliferation and publicly funded infrastructure spending continued to push stocks higher, helping large caps in particular, this was a more nuanced rally than we witnessed at the end of last year. High beta stocks, with greater market sensitivity, underperformed in January as the market appeared to be gravitating toward higher quality, larger-cap names. Within the value universe, small value trailed large by 7% through mid-March as measured by the performance of the Russell 2000® Value Index relative to the Russell 1000® Value Index.

We believe this sets up an environment where a tempered and balanced approach makes sense. Though the market appears to be ignoring the possibility of an economic recession and is instead focusing on an ‘early cycle’ recovery, we don’t think this rosy scenario is a sure bet, although it remains one possible outcome on a spectrum of scenarios.

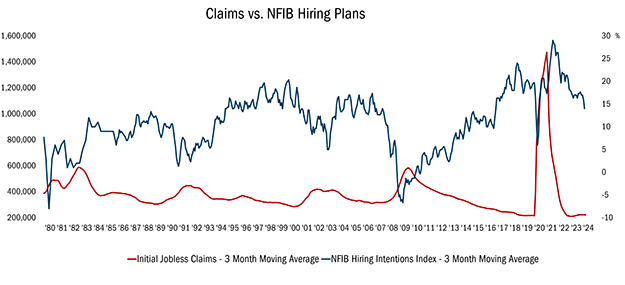

Indeed, while the economy continues to produce jobs at a decent clip, there are cracks developing in the labor market. Historically, there’s been an inverse correlation between jobless claims and the National Federation of Independent Business (NFIB) Hiring Index. Lately, small business hiring intent has been headed in the wrong direction, perhaps a consequence of small business optimism falling below levels preceding past recessions of 2020, 2001, and 1990.

Source: FactSet Research Systems Inc., monthly data from 1/31/1980 to 3/31/2024. This chart represents the small business hiring demand is waning, which historically is inversely correlated with raising joblessness. National Federation of Independence Businesses (NFIB). All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

That’s not to say we are bearish. However, we will not take our eyes off potential downside risks in hopes of capturing every ounce of a perceived early cycle upturn. At the very least, it’s important to recognize that the margin of safety has diminished given recent performance.

Attribution Analysis

Our Strategy gained 6.58% in the first quarter, trailing the Russell 3000® Value Index, which posted returns of 8.62%. Stock selection detracted from the Strategy’s performance in the quarter, particularly in the Industrials, Technology, and Health Care sectors.

There was a ‘big’ reason for that underperformance. Our Strategy has been meaningfully underweight stocks in the top decile of market capitalization. Meanwhile, the first quarter rally was led by large caps, thanks in part to the excitement surrounding AI. Better earnings revisions among companies in the Russell 1000® Index versus those in the Russell 2000® Index also helped.

Over the past 12 months, however, our Strategy outperformed the benchmark, gaining 19.19% versus 20.18% for the Index, thanks almost entirely to stock selection.

Portfolio Activity

We construct our portfolio from a bottom-up perspective, including our allocations to small-, mid-, and large-caps. Our overall exposure to the latter rose 3 percentage points in the quarter to 33%, because of the outperformance of our large-cap holdings and because we added a compelling new holding, The Hershey Company, to the portfolio. Similarly, our mid-cap weighting fell by 3 percentage points to 31%, in part because we trimmed or exited several positions, including CBOE Global Markets Inc. and Howmet Aerospace Inc., for valuation reasons.

You can read more about these and other holdings here:

Consumer Staples. When shares of the leading chocolate confectionary company The Hershey Company (HSY) sank 32% from their 2023 peak—owing, in part, to volume headwinds and margin pressures from rising cocoa prices—it created an opening to build a new position.

Consumer Staples. When shares of the leading chocolate confectionary company The Hershey Company (HSY) sank 32% from their 2023 peak—owing, in part, to volume headwinds and margin pressures from rising cocoa prices—it created an opening to build a new position.

The company, known for such popular brands as Hershey’s, Reese’s, Cadbury, and Jolly Rancher, has historically traded at a premium to its consumer staples peers; however, in an environment where consumer finances are stressed and input costs are climbing, that premium has disappeared.

We believe Hershey simply needs to demonstrate to investors that these headwinds are temporary in nature, while once again showcasing its ability to balance superior profitability with modest growth and stable market share. Cocoa prices, a key input for HSY, experienced a nearly unprecedented price spike on supply disruptions in West Africa (where the majority of global supply originates). While we cannot predict when cocoa prices deflate, we are confident HSY and its largest competitors will be slow to reverse price increases required to recoup input cost inflation. Encouragingly, after being hampered by supply chain constraints in the post COVID-19 environment, HSY has a greater product innovation slate and more production capacity to grow in the coming years.

Meanwhile, the stock is trading near historic lows relative to other blue chips consumer staples, the consumer staples sector as a whole, and the broad market.