First Quarter Market Discussion

The narrative in the market has gone from talk of a ‘hard landing’ (deep recession) to a ‘soft landing’ (mild recession) and now possibly ‘no landing’ (no recession) at all. Add to that investors’ hope the economy could get a boost from lower Federal Reserve policy rates, federal infrastructure spending, and/or productivity increases driven by AI technology, and it’s no surprise that risk aversion seemed to evaporate in the first quarter.

Relief that a recession might be avoided and excitement for potential economic re-acceleration pushed the S&P 500 Index up 10.56% in the first three months of the year, while the Russell Midcap® Index rose 8.6%.

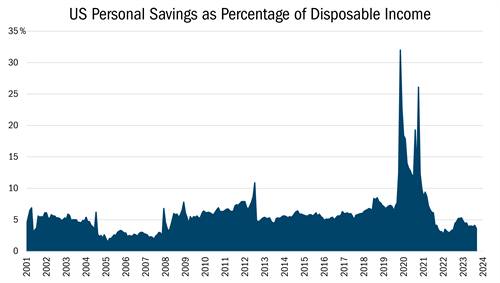

Of course, this excitement overlooks the considerable costs and time that will be required to achieve speculated future AI-related productivity benefits. It also belies cracks in the foundation of the economy that shouldn’t be ignored. In the aftermath of the global pandemic, for example, households have drained down their excess savings, with personal savings as a percentage of disposable income now at historically low levels (see chart below).

Source: Bloomberg, Monthly Data from 6/1/2001 to 2/29/2024. This chart represents US Personal Savings as Percentage of Disposable Income. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Consumers aren’t just saving less, they are borrowing more too. Auto loans, borrowing against 401(k)s, and credit card balances are all on the rise, as are delinquencies on repaying that debt. Consumers should not be the only concern. More than $2 trillion of commercial real estate debt is set to mature between now and the end of 2028, suggesting the potential for rising defaults in that space yet distressed commercial property sales remain muted.

We are not entirely convinced of the ‘no landing’ narrative that is dominating the markets. However, we also understand it is one possible outcome on a spectrum of many scenarios. We cannot allow these macro questions to drive our decision making because the answers are unknowable, and the equity market is a discounting mechanism. As such, our job is to allocate capital towards the most attractive opportunities in the midcap value universe while managing risk through sound portfolio construction.

Attribution Analysis

The Mid Cap Value portfolio gained approximately 5.7% in the first quarter, lagging the Russell Midcap® Value Index, which was up 8.2%. Most of the underperformance was driven by a low hit rate on our stock selection in Financials and Industrials, where our Strategy trailed benchmark constituents.

Our underperformance was driven by the securities we hold and by the ‘opportunity cost’ of not owning certain other stocks within the midcap universe. The latter headwind was particularly noticeable in Financials, where securities that appear misplaced in the Russell Midcap® Value Index including Coinbase Global, Inc., Robinhood Markets, Inc., Block, Inc., and SoFi Technologies Inc. make up more than 6% of the sector.

In the first quarter, cryptocurrency-related stocks Coinbase and Robinhood saw their shares surge more than 50% as the price of digital tokens jumped. Our commitment to attractively priced, well-run companies with strong fundamentals—guided by our 10 Principles of Value Investing™—prevents us from owning these businesses, and we are quite comfortable with this positioning. We believe that our efforts are better spent identifying undervalued shares of financially strong businesses, even if it takes time for the markets to see their true value.

Regarding businesses we owned that were detrimental to performance, First American Financial Corporation (FAF) in the Financials sector and J.B. Hunt Transportation Services, Inc. (JBHT) in the Industrial sector were detractors to overall performance. Both are industry-leading cyclical businesses currently working through the weak point in their business cycles, including title insurance in the case of FAF and freight transportation in the case of JBHT. Our thesis for owning both remains unchanged.

Portfolio Activity

We construct our portfolio for the long term with a balanced and bottom-up approach. Overlaying our 10 Principles of Value Investing™, we implement a two-bucket strategy by seeking to own both high-quality companies trading at decent bargains (“quality value”) and deeply discounted companies that have produced poor economic returns over time (“deep value”). We do this because these two styles within value investing tend to alternate market leadership, just as growth and value strategies generally take turns outperforming.

Today’s economic backdrop offers a good illustration of how the two-bucket approach can be useful. While we are skeptical that investors’ expectations of a ‘no landing’ scenario will unfold precisely as expected, we also can’t say for certain that conventional wisdom is wrong. If the market continues in a ‘risk on’ mode, deep value securities could have an outsized benefit. On the other hand, if the economy is weaker than current market expectations, capital is likely to favor quality value characteristics including high returns on capital, robust free cash flow, and pricing power. That said, we question whether the market will pay any price for those attributes, which often seemed to be the case in the pre-2022 interest rate environment.

The following are two examples of new holdings in the quality value category and one example of a detractor in the deep value bucket:

Industrials. Donaldson Company Inc. (DCI), a filtration manufacturer with more than a century of experience in air, lubricant, hydraulic, and fuel filtration applications, is a new position this quarter.

Industrials. Donaldson Company Inc. (DCI), a filtration manufacturer with more than a century of experience in air, lubricant, hydraulic, and fuel filtration applications, is a new position this quarter.

DCI, an example of a stock in our quality value bucket, typically trades at a premium to its peers, an indication of the market’s appreciation for its economically resilient revenues and high profit margins. However, the company has faced margin headwinds lately, in part owing to heavy upfront investment in its fast-growing life sciences segment. Moreover, several of DCI’s cyclical end markets, including agricultural, mining, and construction equipment, have been under pressure as lower equipment utilization has translated into fewer filter replacements.

We think investors have already incorporated the life sciences operating losses in the company’s valuation, but we believe the segment will ultimately be accretive to revenue growth and margins. If life sciences operating margin approaches the corporate average of around 15% over the next two years, that could translate to a 10-15% lift in total earnings power. For context, this segment’s operating margin exceeded 20% prior to the current investment phase.

Investors don’t typically gravitate to industrials when the ISM Manufacturing Purchasing Managers Index is declining, as was the case from late 2021 through late 2023. Donaldson, however, has historically outperformed in scenarios when industrial activity weakens owing to a revenue base that is mostly consumable. This makes Donaldson a good example of a stock that could perform well on a relative basis if the economy slips into a recession while providing significant upside potential if the economy continues to grow.

DCI is trading at parity today, implying that the market is already pricing in further earnings pressure while we expect the life sciences operational improvement to help buffer potential profit risk in the company’s cyclical end markets.

Consumer Staples. Another new position is The Hershey Company (HSY), the leading chocolate confectionary company in North America with a growing presence in salty snacks and non-chocolate confections.

Consumer Staples. Another new position is The Hershey Company (HSY), the leading chocolate confectionary company in North America with a growing presence in salty snacks and non-chocolate confections.

The maker of such popular brands as Hershey’s, Reese’s, Cadbury, and Jolly Rancher has historically traded at a premium to its consumer staples peers. But in an environment where consumer finances are stressed and input costs are climbing, that premium has disappeared. The stock is down 35% from its 2023 peak due to volume headwinds and margin pressures brought about by rising prices.

We believe Hershey simply needs to demonstrate to investors that these headwinds are cyclical and temporary in nature, while once again showcasing its ability to balance superior profitability with modest growth and stable market share. Cocoa prices, a key input for HSY, have seen a nearly unprecedented price spike on supply disruptions in West Africa (where the majority of global supply originates). While we cannot predict when cocoa prices deflate, we are confident HSY and its largest competitors will be slow to reverse price increases required to recoup the input cost squeeze. Encouragingly, after being hampered by supply chain constraints in the post-COVID-19 environment, HSY has a greater innovation slate and more capacity in place to grow in the coming years. The stock, meanwhile, now trades near historic lows relative to other blue chip consumer staples, the consumer staples sector as a whole, and the broad market.

Healthcare. Perrigo Company PLC (PRGO) is an existing deep value holding that has slumped lately, but we’re encouraged by the self-help progress.

Healthcare. Perrigo Company PLC (PRGO) is an existing deep value holding that has slumped lately, but we’re encouraged by the self-help progress.

Shares of the consumer health company, with private-label brands spanning allergy and pain relief to digestive health products, fell in response to news that the cost to remediate its infant formula plants will run higher than expected. Last September, the Food and Drug Administration updated industry guidelines for the agency’s approach to inspections and compliance for infant formula production. This included more frequent cleaning of manufacturing facilities, resulting in a slowdown in production.

While the stock reacted to the disappointing infant formula update (which impacts 12% of company sales), we took away notable positives from PRGO’s earnings update including clear signs of progress on market share, margins, and free cash flow generation. More recently, shares have recovered after the CEO appeared at an industry conference and reported faster-than-expected progress made on infant formula remediation. Ongoing progress on the issue should help refocus investors on the positive developments underway.

Part of PRGO’s self-help strategy includes making its U.S. operation look more like its business in the United Kingdom, where higher priced versions of the same molecule are manufactured/sold through PRGO’s existing footprint (analogous to a “good/better/best” product offering often deployed by retailers). In a very asset-efficient manner, these newer products can be sold at 2 to 2.5 times the gross margin of a store-branded drug.

Perrigo is also in the process of eliminating unproductive product lines, as more than 1,500 stock keeping units drive just 1% of operating profit. The stock is enjoying considerable insider buying and is attractively priced at just 12 times earnings.

Outlook

In the long run, our stock-picking success hinges on avoiding short-term speculation and staying true to 10 Principles of Value Investing™, which demands that we stick with well-run companies possessing strong balance sheets that are also trading at attractive valuations. We remain focused on what we can control, including 1) investing in quality value businesses that we think are trading at an appropriate discount to their intrinsic value while avoiding those that lack valuation support; 2) holding an equal-to-overweight position in the quality value category while maintaining adequate representation in the deep value bucket; and 3) purchasing deep value businesses only after identifying a self-help catalyst that we believe can unlock value with execution. Over periods measured in years not quarters, this strategy has served us well.