At the start of the quarter, the mood of the market continued to alternate between euphoria over a potential Federal Reserve pivot and hand wringing over interest rates, inflation, and jobs — as was the case for much of the second half of 2022. Then in March came the collapse of Silicon Valley Bank, Signature Bank, and Silvergate Capital, and suddenly, the economy had a banking crisis on its hands.

As financials make up the largest sector in most value indexes, it’s not surprising that value investors are paying particularly close attention to the health of banks. Are we surprised Silicon Valley Bank went from being the country’s 16th largest bank to non-existent in a matter of days? Absolutely. But was it unexpected that the financial health of certain banks would be called into question? Not at all. The lack of focus on both interest rate and credit risk following a prolonged period of artificially low rates set the stage for the Federal Reserve to “break something” following a 180-degree policy shift over the past year.

The events over the past few weeks don’t change our big-picture views, but they do make us reassess earnings power potential and valuation targets for financial institutions who may experience a more onerous regulatory burden going forward. While we are underweight financials in general, we do have exposure to banks. But the businesses held in the strategy have high-quality funding bases and conservative credit underwriting standards. We aren’t playing defense, rather we favor fundamental traits such as financial soundness and sound business strategies as part of our 10 Principles of Value Investing™ that provide potential margins of safety.

As part of our process, we also set four price targets for every security that we analyze — two for positive outcomes and two for negative scenarios. Those downside targets are particularly useful in challenging environments like this. Right now, signs continue to point to a slowing economy and deteriorating fundamentals, and recent troubles in the banking sector will likely only accelerate that.

Ultimately, the banking crisis reinforces the advantage that active value investors have over passive strategies. At a time when balance sheet strength matters more than ever, it’s important to note that passive investments do not actively incorporate financial health considerations in portfolio construction. For us, financial health is integral to several of our 10 Principles of Value Investing™.

Attribution Analysis & Portfolio Activity

For the quarter, the strategy outperformed the Russell 3000® Value Index. While stock selection gave us an advantage in Industrials and Financials, we lagged in other areas including Communications and Health Care. For the past one, three, and five years, however, security selection has accounted for the vast majority of our performance.

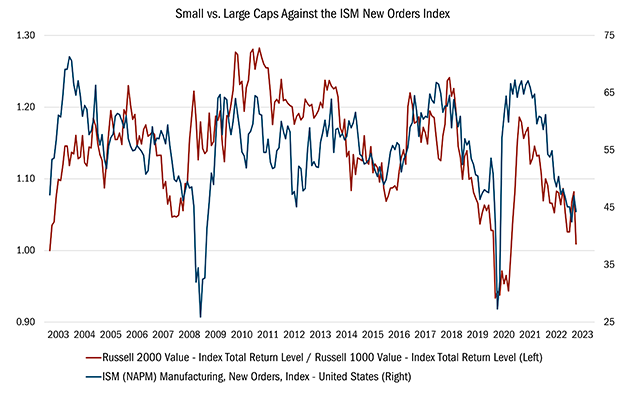

Late last year, we had been buying shares of well-run small-cap businesses that we thought were positioned to be the leaders at the start of the next cycle. But after the “risk on” rally at the start of this year, which drove up prices throughout most cyclical areas of the market, mispricing opportunities were harder to come by, and this became less of a priority. As depicted in the following chart, small caps outperformed large caps by ~600bps through February only to lag by ~700bps in March.

Source: FactSet Research Systems Inc., monthly data from 4/30/2003 to 3/31/2023. This chart represents Small Caps vs Large Caps against the ISM new order index. The ISM Manufacturing New Order Index is an index based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The New Orders Index compares current month orders with the prior month. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

We believe this is time for a more balanced approach, looking to take advantage of what the market gives us. For example, early in the quarter, we added to Utilities and Consumer Staples, which were largely left out of the speculative rally in January and February. We continue to see value in smaller businesses because the market is increasingly discounting an economic recession. For example, the Institute for Supply Management (ISM) Manufacturing New Orders Index (blue line) is a diffusion index that signals economic contraction below 50, a level it has hovered below since September 2022. Historically, investors have been rewarded for going down market when economic prospects are dim as they are today.

Consumer Staples. For example, we established a new position in Ingredion Inc. (INGR), a less than $7 billion market capitalization global food products company that converts corn, tapioca, potatoes, grains, fruits, and vegetables into ingredients and biomaterials used primarily in the food and beverage industries. Ingredion’s business has been under pressure in recent years for several reasons. First, high-fructose corn syrup has been in secular decline because of shifting dietary preferences toward natural sweeteners, and second, inflationary pressures have put downward pressure on margins largely due to a spike in agricultural commodity prices.

Consumer Staples. For example, we established a new position in Ingredion Inc. (INGR), a less than $7 billion market capitalization global food products company that converts corn, tapioca, potatoes, grains, fruits, and vegetables into ingredients and biomaterials used primarily in the food and beverage industries. Ingredion’s business has been under pressure in recent years for several reasons. First, high-fructose corn syrup has been in secular decline because of shifting dietary preferences toward natural sweeteners, and second, inflationary pressures have put downward pressure on margins largely due to a spike in agricultural commodity prices.

We’re attracted to several profit enhancement initiatives that, when combined with a customer-demand profile that is relatively inelastic and an attractive valuation, provide potential downside protection. The company’s self-help drivers include raising prices to offset previously realized inflationary headwinds and driving its high-margin specialty segment to a larger percentage of its overall sales. In addition, within the company’s lower growth ingredients segment, management is repurposing production capacity toward higher-value products.

INGR has historically traded at a 20-30% discount to its sector peers. Today, INGR trades at 7.9 times consensus EV/EBITDA over the next 12 months, which is around a 40% discount.

The freight market weakened meaningfully in 2022 following a robust recovery coming out of the COVID-19 pandemic. Because supply chains were a significant bottleneck for businesses over the past few years, management teams ordered “buffer inventory” to ensure product availability for internal consumption and for sale to customers. But in 2022, shippers recognized they had too much inventory as lead times improved across supply chains. In response, JBHT’s customers slashed orders, freight rates fell, and investors grew concerned about management’s decision to double the company’s intermodal fleet by the end of 2025.

We believe weakening freight demand, easing supply chain pressures, and railroad investments will cause customers to refocus on optimizing freight cost, which should benefit Hunt. The company is investing capital now on network expansion, and we believe the associated profits will come over time. The stock normally trades at parity or a slight premium to the industrial sector. But at 9.25 times consensus EV/EBITDA over the next 12 months, Hunt shares are at around a 20% discount to the company’s peers.

J.B. Hunt operates with very little debt, and the management team has a track record of investing through economic downturns. Combining management’s history of strong capital allocation and a discounted valuation gives us confidence that Hunt can outperform through a recession and into an economic recovery, whenever that may happen.

Interactive Brokers’ differentiated business model shined because the company’s management team built the business to avoid the two risks that came to the forefront for sector peers this quarter, credit and interest-rate risk. IBKR is a prime example of why analyzing businesses under multiple scenarios, both good and bad, is so important. In late 2021, when we began purchasing IBKR, the market was not pricing credit or interest-rate risk into the sector. Banks appeared optically “cheap” on P/E multiples, but after adjusting for downside risks, the upside versus downside potential was far more compelling in Interactive Brokers than in banks. Today that gap has narrowed, however, we continue to hold a position in IBKR given its lack of credit risk, which has yet to be fully priced into many banks.

IBKR enjoys industry- and sector-leading pre-tax margins thanks to its highly automated platform that drives scale efficiencies, which are partially passed on to customers in the form of attractive interest rates on cash balances. For this reason, clients have little incentive to move deposits as interest rates rise. IBKR’s management team has refused to take duration risk thereby significantly lowering the chance of a “run on the bank” scenario that proved disastrous for several banks this year. Credit risk is limited to securities-backed loans that are over-collateralized and marked to market in real time thereby significantly reducing any loss given default.

While the knee-jerk reaction to the budding banking crisis is to act defensively, we think this is a great backdrop for a balanced approach — one that considers both defensive and offensive opportunities, whichever is most attractive.

We understand that the near-term volatility caused by liquidity concerns isn’t fun. But we love a backdrop where we can find well-run businesses with sound management strategies, strong balance sheets, and robust cash flows that are being punished in the short run, with the understanding that these investments will be worth a lot more in the next few years.

We thank you for your continued trust and confidence.