At year end, based on a historic valuation gap, we professed our enthusiasm for small stocks versus their mega-cap brethren. Mr. Market proved us wrong, with the S&P 500 up 10.6% in the first quarter, compared with the Russell 2000® Value Index, which was up only 2.9%. In the long run, we’re confident a portfolio selected on the merits of low price to earnings and low debt with strong revenue growth prospects makes sense.

Our confidence is couched in classic Ben Graham value investing principles.*

The Value Fund is priced at 12X estimated profits for an 8% earnings yield (calculated by inverting the P/E ratio). According to Graham, to account for equity risk, earnings yields should exceed payouts available in the bond market. Also in our view, the Fund’s P/E is attractive to the S&P 500’s 22X multiple.

Yet investors often overlook opportunities in undervalued parts of the market because they get caught up in popular names that grab the headlines. Thus, Ben believed it takes strength of character and patience to wait for openings that others don’t see.

What might be the catalyst that will shift the spotlight to the value present among small caps?

Small stocks took a disproportionate hit when interest rates began to rise two years ago on the belief that emerging companies rely more on bank financing than blue chips. By that token, they should be early beneficiaries once the Federal Reserve begins to loosen monetary policy, which is expected to start later this year.

These businesses — and the executives who run them — are also out to prove their worth. In the face of low investor interest, we are witnessing a growing number of firms stepping up on attractive valuations by instituting share buybacks. At the same time, insiders at these companies are increasingly buying their own shares.

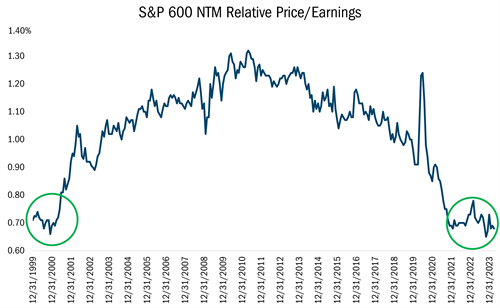

This part of the market also enjoys another advantage: If investors are concerned about the possibility of a recession lurking around the corner, many small businesses have already experienced a de facto downturn. Their equity prices, on a relative basis compared with S&P 600 companies, are at their lowest levels since 2000, which, by the way, proved to be a great time to be buying small caps (see chart below).

Source: FactSet Research Systems Inc., monthly data from 12/31/1999 to 3/31/2024. This chart represents the S&P 600 next twelve months relative price to earnings ratio. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Attribution Analysis & Portfolio Activity

For the quarter, the Heartland Value Fund returned 6.7%, outperforming the 2.9% gains for the Russell 2000® Value Index. Almost all of that was attributable to stock selection, which was particularly strong in the Financial, Industrials, and Consumer Discretionary sectors. Over the past year, the Fund also outperformed, up 21.7% versus 18.8% for the benchmark, again driven primarily by stock selection.

After the market’s recent run-up, the opportunity set doesn’t appear as attractive as it was last Fall, even within the small value universe. There are fewer compelling buys, and we remain focused on a balanced approach driven by a risk-reward mindset.

We continue to focus on taking what the market gives us while waiting for fat pitches to come our way. This quarter, for instance, we started a new position in Chart Industries, Inc. (GTLS). We’ve been monitoring the stock for years and finally saw the buying opportunity we’ve been waiting for. As the leading producer of equipment for the shipment of liquefied natural gas (LNG), Chart Industries sold off sharply on the Biden Administration's decree to pause new export permits.

We view the pause as a short-term political action in anticipation of the coming election. In any case, GTLS has robust backlogs for the next several years. And if the U.S. truly slows, Chart, an international provider, should benefit as the rest of the world accelerates LNG development.

With an improved outlook due to the growth of a 2023 acquisition and its integration, Chart provides a broad product line across vast global end markets. This includes leadership in heat transfer systems and gaseous equipment used as alternatives to traditional fuels in hydrogen, carbon capture, and water treatment.

Chart’s Q4 was better than expected with record orders and increased sales, gross profit margin, operating income, and free cash flow. Due to above-plan integration synergies, GTLS built cash, paid down debt, and earned a recent upgrade in its bond rating. Now that one third of its revenues are coming from short-cycle maintenance and service, added benefits include higher margins and increased sustainability.

The company guided to another record year. We estimate sales of $4.8 billion, up from $3.7 billion in ’23. Adjusted earnings per share are estimated at $12, versus $6.09 a year ago. Priced at 8.3X estimated EBITDA, a substantial discount to peers, we view Chart Industries as an attractive value.

We believe Chart represents a better opportunity in the Industrials sector than BWX Technologies (BWXT), the nuclear components manufacturer we sold in the first quarter.

BWX was a profitable investment, but two catalysts drove valuations to a level we deemed fully priced. For starters, BWX’s development of small nuclear reactors gained steam, with appeal to Energy sector customers. So, too, did the company’s work on medical nuclear isotopes, critical to healthcare supply and security issues.

We sold the stock, which jumped 33.7% in the quarter, after hitting our price target. At 30X earnings, BWX’s risk-reward proposition disintegrated.

Elsewhere in our portfolio, we added to our position in the consumer health goods company Perrigo (PRGO) in the fourth quarter after its sell off, which was largely driven by troubles in the company’s infant nutrition business.

Last September, the Food and Drug Administration updated guidelines for the agency’s approach to inspections and compliance for infant formula production. This included more frequent cleaning of its facilities, which resulted in slowing output. We see the manufacturing headwind in this space as a temporary challenge. Perrigo, in fact, recently provided an encouraging update on its remediation efforts.

Ongoing progress on the issue should help refocus investors on the positive developments underway. This includes making its U.S. business, which is largely focused on lower-cost and lower-margin private label brands for retailers like Walmart and CVS, more like its European business, which focuses on higher-margin national brands. The good news: It can make this transition while utilizing its existing distribution and manufacturing footprint. Perrigo is also in the process of eliminating unproductive product lines, as more than 1,500 items drive just 1% of operating profit.

Meanwhile, the stock is enjoying considerable insider buying, and we believe it is attractively priced at just 12.2 times earnings.

Outlook

The first quarter demonstrated that investors aren’t quite ready to give up the mega-cap growth ghost. Yet, in our opinion, this does not detract from the historic appeal of small value. The part of the market we have devoted more than 40 years researching has only sold at such steep discounts relative to large caps three other times. The market may not be paying attention now, but we are convinced it eventually will. As value investors, it’s our job to remain disciplined and focused on the fundamentals until that happens. We will continue to use our 10 Principles of Value Investing™ to guide us, helping us find opportunities with low prices relative to earnings and cash flow to create a margin of safety.

Fundamentally and patiently yours,

The Heartland Investment Team

* If you’d like to learn more about the principles of value investing and want a free copy of Ben Graham’s The Intelligent Investor, we would be happy to send you one, until supplies last. Please contact us at 414-977-8746.